- The Dogecoin whales have sold another important part of their assets in the last 24 hours, influencing the pressure downwards.

- DOGE could establish new hollows as a feeling on several lower lower measurements.

In the past 24 hours, DOGECOIN (DOGE) Recorded a market drop by 17.64%, bringing its monthly loss to 36.43%, a clear sign that DOGE continued to make a series of lower stockings on the market.

Analysis has shown that whales played a major role in the recent drop in the Doge market. Now, other retail traders have joined the lowering feeling, probably contributing to new decreases.

The sale of whales causes greater consequences

Whales, or large investors controlling between 100 and more than a billion Doge, have sold 270 million Doge in the last 24 hours, forcing a drop in prices and market loss.

As a rule, a major sale like this implies that these cohorts are trying to either make profits, break even or reduce their losses.

This is often followed by a series of downward price movements until significant purchase activities are recorded.

These whale sales have had an impact on other market players, who close their long contracts while the downward wave takes control of the market.

Derived transactions remain lowered

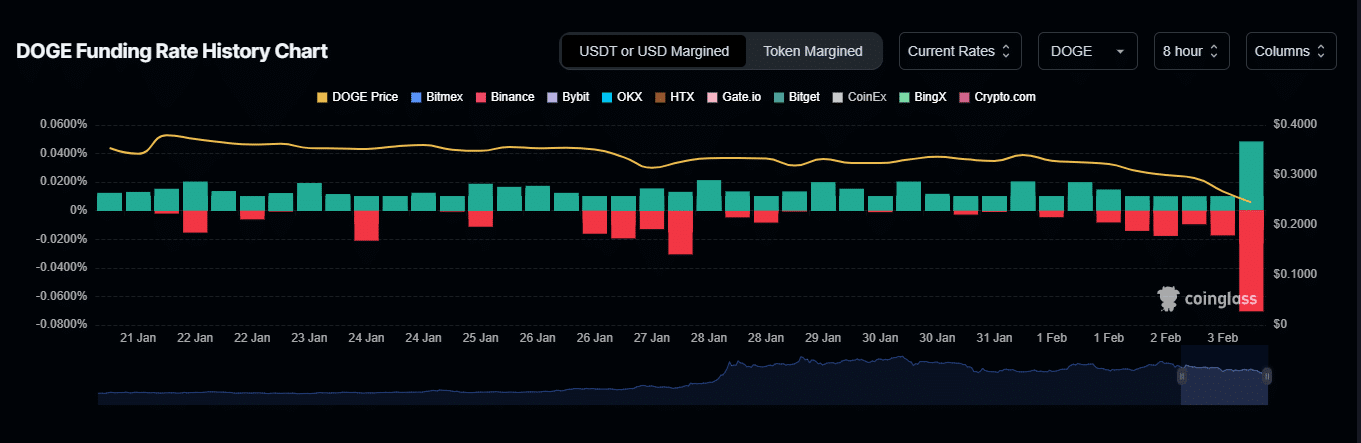

The positions of the merchants derived on the market have become lowering as two key measures – the funding rate and open interest – have changed negatively.

The financing rate, which shows whether buyers or sellers are in control depending on which group pays the premium to maintain the price balance on the Spot market and ultimately, indicates that sellers control.

This is confirmed by a negative financing rate. At the time of the press, the Doge financing rate was 0.0245% negative, which means that perpetual contracts were dominated by the sellers.

The open interest (OI), which measures the amount of unstable derivative contracts on the market, shares a similar feeling.

At the time of writing the editorial staff, Oi decreased by 30.08% to 2.53 billion dollars, suggesting that derivative traders close their positions and that liquidity outputs occur, adding more pressure downward.

Long Dogecoin burns

Haussiers traders have undergone major market losses in the past 24 hours, given the current downward trend. At the same time, the liquidation data opposed a market rally, because the traders have been downgraded to all deadlines.

During the last hour only, $ 2.31 million long positions in liquidation were closed, against $ 99,880 in short positions.

This great disparity between long and short contracts within lower time has highlighted the depth of the downward trend.

Read Dogecoin price prediction (DOGE) 2025-2026

Overall, this downward trend persists, with exactly $ 69.46 million in long positions on DOGE, while short positions represent only $ 18.94 million.

If this continues, there is a high probability that DOGE continues to record new stockings and the market will undergo new losses.