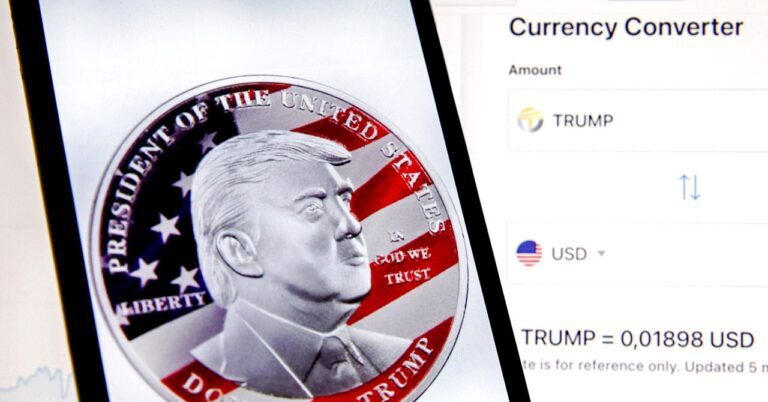

Crypto portfolios that invested the most important sums in Trump largely bought the medal on January 18, the day it was launched, according to Nansen Analysis. The portfolios that reached the greatest return on their investments Trump, for their part, had largely sold their assets by January 20, when the price had already dropped from its peak. Circulating Trump parts are now estimated at $ 5.4 billion.

“The earlier you are, the more you can bet.” But if you have bet a lot, it does not make sense to stay long, because it will not be (next) apple or nvidia, “explains Barthere. “There is zero value. So, for sure, it will fall.

Among the portfolios that have Most beautiful profit From Trump, according to Nansen data, many who have treated relatively small, which implies that some ordinary people have managed to beat the crowd in the same way as large traders. In the midst of high -value trades placed by J9TXV and others in the minutes launched by Trump, chair traders Throw as much as $ 50.

Beyond an incredible blow of fortune and Galle, Sibenik and Powers claim, only one other theory could explain that traders plowed hundreds of thousands of dollars in Trump so shortly after being revealed: the trades were Placed by automated sniping boots.

Sniping bots are generally programmed to enter several different parts immediately after the launch, explains Powers. Some wallets used to place Trump’s first trades contain dozens of other guysbut othersincluding J9TXVcontain only a few.

“What we do not expect to see a bot would be an acquisition of a token only with a great position, especially if this token had not been announced previously. This activity seems too specific, ”explains Powers. “How do you code the script for a bot to acquire a token before knowing that it exists?”

Most sniping robots are also scheduled to treat in smaller amounts, explains Sibenik. “(Early large traders) are initiates or information from another party are more likely explanations, in particular given the very large amounts invested,” explains Sibenik.

In the absence of all the rules governing the same in the United States, it cannot necessarily be illegal for a transmitter to give early notice to the parties.

Recently, multiple Federal proceedings brought by investors have sought to argue that even the same should notes laws on securities, governed by Securities and Exchange Commission, a regulatory agency responsible for protecting American investors. But in an interview On January 23, the venture capital David Sacks, appointed by Trump as American IA and CSAR Cryptosaid the same should be treated as a type of collection, an unregulated asset class.

In an executive decree signed on January 23, Trump created a “Digital asset working group», That he responsible for recommending regulations and legislation linked to appropriate cryptography.

“The cryptocurrency industry is still on the clarity of the regulations. The main actors want to be considered as actors in good faith in the financial markets, ”explains Powers. “There has been an inconvenience expressed from the interior of the industry (crypto) of this memecoin offer that seemed to enjoy the moment.”

At the foot of Trump websiteA small printed non-responsibility clause claims that the same is “not intended to be or the subject of an investment opportunity, an investment contract or security of any type ». THE Terms and ConditionsIn the meantime, stipulate that investors must give up the right to continue a collective appeal compared to the same. They also claim that investors are not allowed to undergo damages, even in the event of “deceptive and unfair business practices” and “false declarations” on the part of the company affiliated to Trump administering the play.

“It’s an amazing warning,” says Powers. “The question of whether this kind of derogations and non-liability clauses would do to justice is another matter. But to set up the road with this attitude does not in accordance with the hope of the cryptography industry to turn the page on what preceded. »»