Key takeaways

- Snowden criticizes Solana for its centralization, which impacts the integrity of its blockchain.

- Despite the criticism, the price of Solana’s SOL token has increased by 10% over the past month.

Share this article

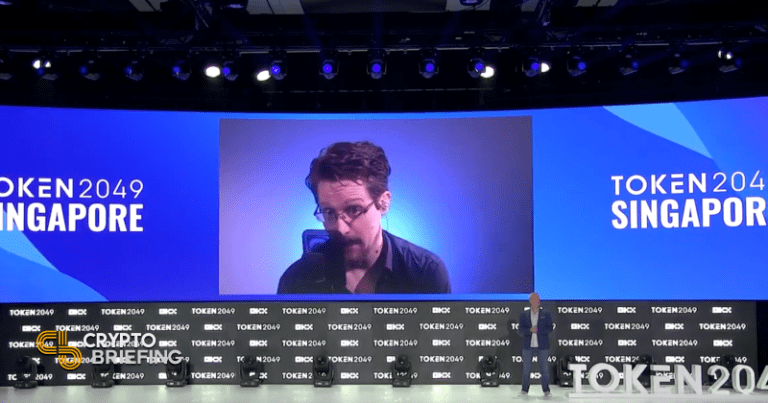

Edward Snowden, the former NSA whistleblower, has openly criticized the Solana blockchain network for its centralization. Speaking at the Token2049 conference via video link, Snowden expressed concerns about Solana’s operating model, describing it as a system vulnerable to manipulation by nation-states and bad actors due to its centralized structure.

Edward Snowden – “Solana is centralized”pic.twitter.com/3NZZPyRLm3

– Altcoin Daily (@AltcoinDailyio) October 2, 2024

Snowden pointed out that while Solana has technological advantages in terms of speed and efficiency, these come at the expense of decentralization.

“Solana takes some good ideas and says, ‘What if we centralized everything?’ It will be faster, more efficient, cheaper… and yes, no one uses it except meme coins and scams,” Snowden remarked.

His criticism highlighted the platform’s focus on performance over the blockchain’s core principle of decentralization, sparking heated debate within the crypto community. The debate over the centralization of Solana is not new. Crypto advocates have previously pointed out that the platform’s governance structure is too centralized.

Most recently, a prominent supporter of Cardano provided evidence that more than 73% of Solana validators comply with KYC and AML requirements. These validators receive grants from Solana’s Stake-o-matic tool, making the network resemble a more traditional financial institution rather than a decentralized blockchain.

Despite these concerns, Solana’s native token, SOL, has seen substantial growth, with its trading price reaching $145 at the time of writing, a 10% increase over the past 30 days.

Snowden’s criticism comes at a time when Solana is attracting a lot of attention due to its low transaction costs and high processing speed. Industry analysts, including those at VanEck, have foreseen that Solana’s market value could increase due to its superior transaction efficiency, predicting a rise in SOL’s price to $330.

According to VanEck, Solana’s ability to process thousands of transactions per second, far surpassing that of Ethereum, makes it a serious competitor in the DeFi and payments space.

Share this article