The XRP price targets $ 4.62 as the constructions of bullish Momentum. Trump Coin and Dogecoin Eye Rallyes in the middle of the activity of whales, regulatory progress and pro-Crypto developments.

Photo Meta – The overvoltage of the XRP price is interested in Trump and Dogecoin in the middle of the optimism of the crypto as part of the Trump administration

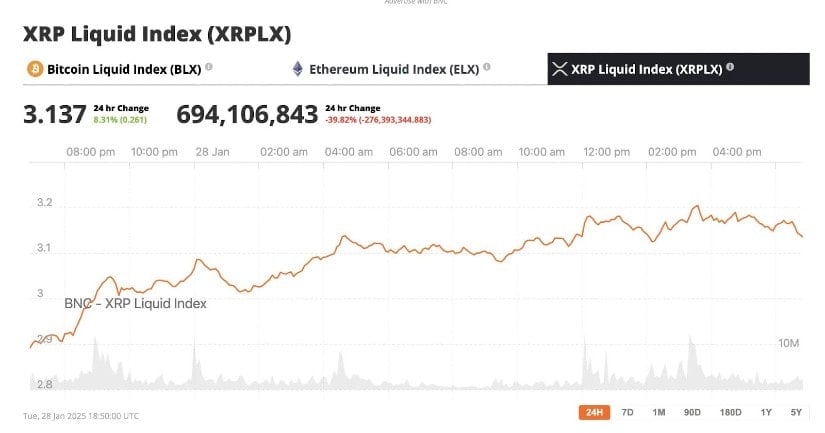

Ripple (XRP) makes the headlines With its big rebound, exchanging more than $ 3.0. The token has increased by 12% in the last 24 hours on the back of solid technical solids and macro. It is a big rebound in the recent lower $ 2.66 and is preparing for more increase.

XRP is up 8% overnight, source: BNC XRPLX

The recent Ripple acquisition of monetary issuer licenses (MTLS) in New York and Texas has been of great price for XRP. These states are known to be difficult to settle, so Ripple’s conformity is a great victory. With more than 50 American MTLs and more than 60 global licenses, Ripple is the leader in cross -border payments.

These licenses allow Ripple to carry out secure, legal and rapid global transactions. This helps XRP adoption and investor confidence. Ripple’s proactive approach to regulation has put them as a trusted player in the cryptocurrency space.

XRP joins Ondo Finance

Ondo Finance should launch his token supported by the US Treasury of $ 185 million, Ousg, on Ledger XRP of Ripple (XRPL) In the next six months. This decision aims to improve institutional access to assets of the real tokenized world by taking advantage of the effective and evolving infrastructure of XRPL.

Ripple and Ondo Finance contributed to seed investments to provide initial liquidity, although the exact amounts are not disclosed. This partnership highlights the growing trend in the tokenization of assets, providing investors faster settlement times and improved efficiency compared to traditional financial systems. This is a new optimist for XRP and Ripple.

Partner XRP and Ondo for Tokenization, Source: X

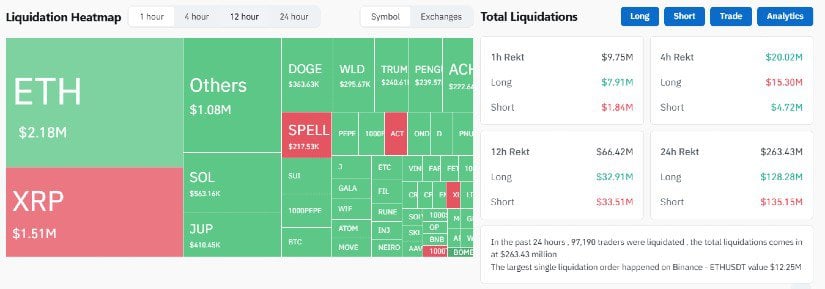

The XRP movement was also helped by Big liquidation on the derivative market. More than $ 4.1 million in short positions have been liquidated in the last 12 hours only. This forced to close their positions and added to the purchase pressure on the token.

Heatmap liquidations: Rinsing

Liquidations can be large catalysts for price movements. We have seen that between January 13 and 16, while $ 56 million in short posts were liquidated and XRP reached a maximum of $ 3.40. This is similar to what is happening today, showing a strong interest and a momentum of the market.

The Taurus flag model suggests a target of $ 4.62

XRP forms a manual bull flag on the daily graphic. This is a consolidation phase after a large movement, which generally precedes a movement towards new heights.

XRP went from $ 2.27 on January 10 to $ 3.40 on January 16 to create the mast. Current consolidation at $ 3.10 is the flag.

Taurus flag on the XRP / USD daily table. Source: Commercial view

A break above resistance to the flag could bring XRP to $ 4.62, depending on the height of the previous movement. This represents 49% of current levels. The RSI went from 58 to 62, showing an increasing purchasing interest and a strong bullish momentum.

Xrp has immediate resistance to $ 3.10, the top of the Taurus flag. A fence above this could arouse a move to $ 4.62. Below $ 2.90 is a key support and a fence below that could delay the increase.

Trump Coin: Can it reach a top of all time?

The inauguration of Trump gave the cryptography market a bullish atmosphere and $ Trump Coin has obtained a lot of media threw since its launch on January 17, 2025. In a few days, Trump went to $ 15 billion, then stabilized $ 5 billion.

Trump’s plan to make the United States “Crypto capital of the worldAnd his appointment of Mark Oida as acting president of the SEC and the creation of a crypto working group led by Hester Peirce Gives Trump a little credit and feeds more media threshing.

Source: X

Currently at $ 26.85 after reaching $ 73.43 on January 19, Trump improves. Analysts predict 230% by February according to the Fear & Greed index.

A corner burst could mean a 90% gain if Bitcoin remains stable. But Trump is a coin and a controlled initiate, so there are concerns about the risks of long -term sustainability and market manipulation.

Critics like John Deaton are warning On ethical and regulatory problems, saying that no restrictive restrictive. Calls to treat conflicts of interest and the use of profits for social causes are underway, but no measure is taken.

Dogecoin: Can Doge hit $ 1 with the influence of Elon Musk?

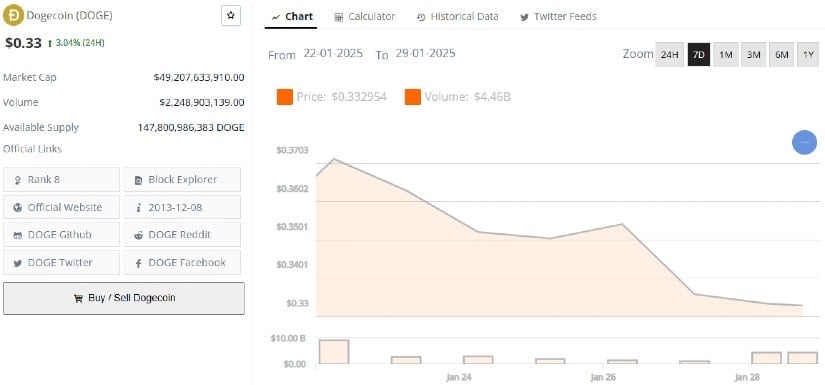

DOGECOIN (DOGE), the king of coins, shows a serious resilience, up 7% intraday at $ 0.33,346. This complies with whale Activity as big investors bought a value of $ 5.7 million in Doge during the recent drop.

DOGE Weekly Chart. Source: Bravenewcoin

Crypto analyst Ali Martinez underlined the massive accumulation of whales during the low price period. If Doge exceeds $ 0.35, analysts expect it to retain $ 0.4835. From there, the sky is the limit at $ 0.7,373 and then $ 1.

Elon Musk always plays a big role in the action of Dogecoin prices. Recent events like him attractive The founder of Dogecoin Shibetoshi Nakamoto “Government department(Doge) excites everyone.

The previous statements of Musk as “Doge to Mars” and its thrust for blockchain to the government have given cases of use of Dogecoin beyond being a meme.

In Breaking Dogecoin News today Bitwise filed an FNB Dogecoin. It will be a solid rear wind for Dogecoin, if the dry approves the FNB of Dogecoin spot.

Bitwise files for a Dogecoin ETF, Source: X

Experts say DOGE could go between $ 0.7373 and $ 1 if it continues. Good for merchants looking for short -term gains and long -term potential.

The cryptography market is still volatile. Global market capitalization I just got below $ 1 billion, investors are cautious. But FOMC’s decision to maintain unchanged interest rates should stabilize the feeling.

Xrp has resistance to $ 3.30 and a support at $ 3. A break in one or the other level will set the tone for the next decision. Trump corner and Mastiff will be based on market account and the broader feeling of investors to support the momentum.