- Dogecoin price fell 5% on Thursday, hitting the $0.35 level as bullish catalysts sparked a news selling frenzy.

- Digital asset management company Bitwise has filed a spot DOGE ETF with the US SEC.

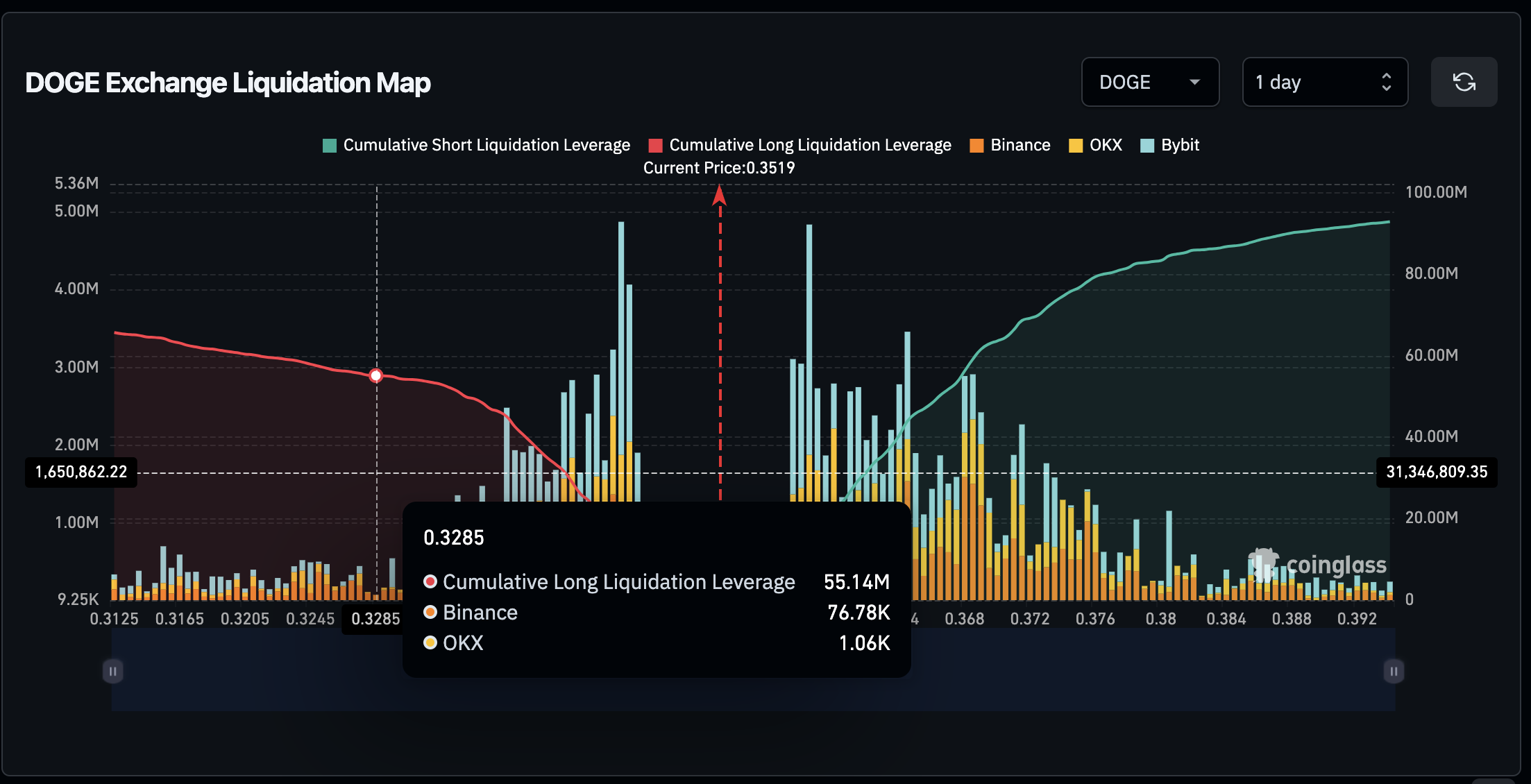

- Bullish traders surged $55 million around the $0.33 level, signaling the prospect of a quick rebound.

Dogecoin price fell 5% on Wednesday, trading as high as $0.35 on Binance. The recent moves signal a news-selling frenzy after a group of bullish catalysts emerged in DOGE markets this week. Can bullish traders expect an early rebound in DOGE prices?

Dogecoin Falls 5% as Trump, Bitwise ETF Spark News Selling Frenzy

Dogecoin price saw strong downward volatility on Thursday, driven by a news selling frenzy despite a series of positive events.

Tuesday, UNITED STATES (United States) President Donald Trump signed the “Department of Government Efficiency” bill, the official website including a Dogecoin logo.

The connection with Dogecoin has sparked positive sentiment from the market due to Elon Musk’s long-standing support for the cryptocurrency.

Asset management firm Bitwise filed a one-time application for a Dogecoin ETF with the U.S. Securities and Exchange Commission (SEC) on Wednesday.

This set of bullish developments, however, appears to have prompted Dogecoin holders to take profits.

Many investors who began buying DOGE during Elon Musk’s public alignment with Trump’s campaigns in September 2024 now have more than 200% unrealized gains.

As Dogecoin achieves notable milestones, these holders have chosen to lock in their profits. As a result, Dogecoin price plunged 5% over the past 24 hours, hitting $0.35 on Thursday.

This sharp decline occurred despite the double tailwind of Trump’s support and Bitwise ETF Deposit.

Based on recent DOGE price movementsthe majority of Dogecoin holders have chosen to book their profits, with Dogecoin having achieved two major feats.

The chart above shows how the price plunged 5% over the past 24 hours, reaching the $0.35 level on Thursday, despite several bullish events.

Dogecoin Price Action, January 23, 2025 | Source: TradingView

Dogecoin Price Action, January 23, 2025 | Source: TradingView

When the price of an asset drops sharply after positive events, as observed in the Dogecoin market this week, it signals a class news selling cycle.

However, since such sales often do not indicate a deterioration in key fundamental factors, traders taking profits on Dogecoin this week may begin looking for buying opportunities at these lower prices.

This could potentially trigger a Dogecoin price rebound in the coming days.

Bullish Traders Deployed $55 Million of Leverage to Prevent a Breach of $0.33

The 5% drop in the price of Dogecoin, which coincides with a positive market development, reflects a widespread trend of profit-taking.

However, Bitwise’s ETF app highlights Dogecoin’s long-term bullish outlook as it attracts new institutional-sized capital inflows.

In response, strategic speculative traders are taking resilient positions, anticipating a rapid rebound in Dogecoin price.

Confirming this outlook, the Coinglass Liquidation Map chart below highlights the total value of long and short leveraged futures positions clustered around current price levels.

Dogecoin Liquidation Map, January 23, 2025 | Source: Coinglass

Dogecoin Liquidation Map, January 23, 2025 | Source: Coinglass

At first glance, bearish sentiment dominates the Dogecoin derivatives market, with active short positions totaling $92 million, far outweighing the $65 million in active long positions.

Although this imbalance signals strong bearish dominance, a rapprochement analysis reveals that more than 80% of the total active short positions on DOGE are concentrated around the $0.33 price level.

This indicates that bullish traders could face liquidations totaling $55 million if Dogecoin price falls below $0.33.

To avoid these losses, traders holding these positions may be forced to initiate hedging spot purchases, which could trigger an early price rebound, particularly if the ongoing sell-off subsides as the initial euphoria surrounding recent sales is fading. news events are dwindling.

Dogecoin Price Forecast: Bulls Regroup at $0.33 for Early Bounce

Dogecoin price is trading at $0.3505, with the daily chart suggesting the possibility of a rebound as buyers work to defend the critical support level of $0.33.

Bollinger bands are narrowing, signaling reduced volatility and a consolidation phase that often precedes sharp directional moves. DOGE price is testing the lower band at $0.35, indicating oversold conditions and potential for bullish momentum if buyers regain control.

Dogecoin Price Forecast | DOGEUSD

Dogecoin Price Forecast | DOGEUSD

The RSI at 47.68 is approaching neutral territory but remains below its signal line, highlighting the decline in bearish strength.

For a bullish scenario, DOGE must decisively recover the midline of the Bollinger Bands at $0.362, which could trigger a rally towards $0.41, the upper band.

The renewed interest from buyers would be supported by an increase in volumes, which remained moderate.

Conversely, a bearish break below $0.33 could expose DOGE to further losses, targeting $0.31 and $0.28.

Traders should watch for volume spikes and movements in the RSI, as divergence could signal the next directional trend.

Amid the ongoing consolidation, the technical price outlook for Dogecoin is cautiously bullish, with critical resistance at $0.41 and the $0.33 support level dictating the near-term trend.