In a sudden shock to the crypto market, Dogecoin rallied this week, before falling back with the rest of the market. A trend is emerging however, Doge is the first to recover when the market is strong. Analysts attribute this to growing institutional interest, coin narrative, and an increase in whale hoarding.

Dogecoinwhich ranks seventh among digital assets with a circulating supply of two million, is attracting the attention of investors who believe its price could rise in the coming months.

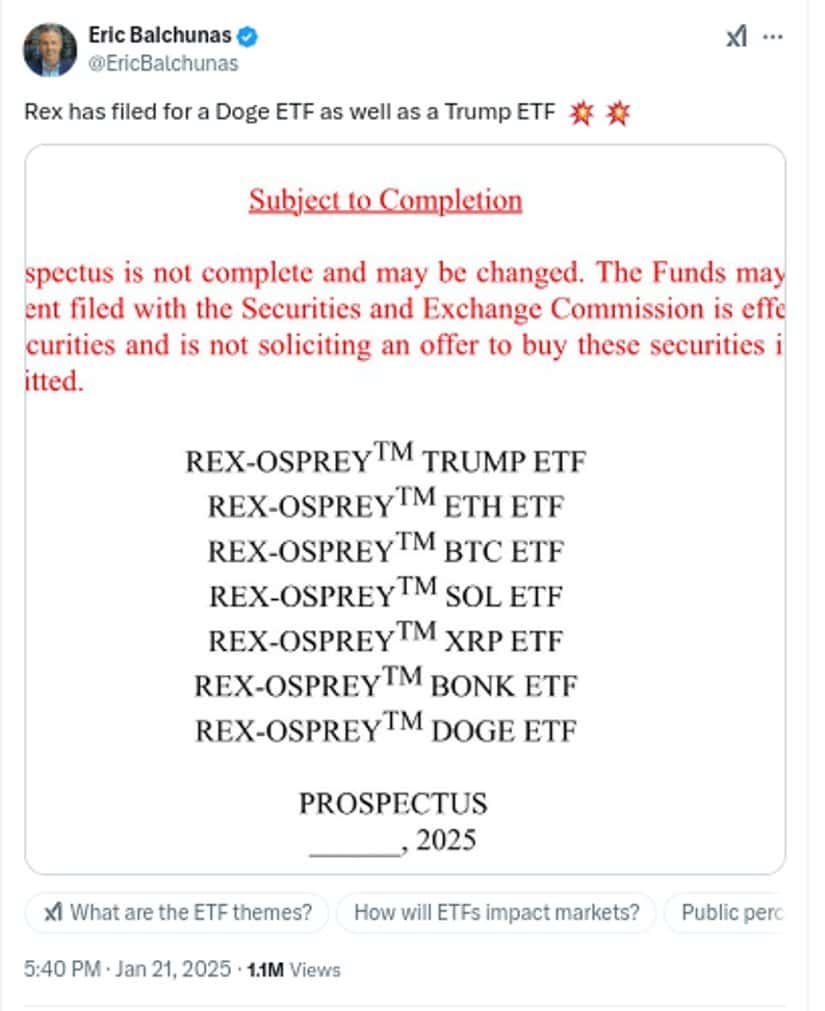

Market enthusiasm has been fueled by potential exchange-traded fund (ETF) deposits that would make it easier for traditional buyers to access the coin. Eric Balchunas, senior ETF analyst at Bloomberg, noted that if the Doge ETF proposals clear regulatory hurdles, the first Dogecoin ETF “could hit the market in early April,” providing a new avenue for retail and retail participation. institutional.

Doge ETF deposits, source: Eric Balchunas

Regulatory Developments and Presidential Spotlight

Part of the buzz around Dogecoin price comes from the changing regulatory climate following the departure by Gary Gensler, former chairman of the Securities and Exchange Commission. A wave of filings has emerged for crypto ETFs linked not only to Bitcoin, XRPand Ethereum but also to meme tokens, in particular BonkAnd Dogecoin. If approved, analysts predict these products could spark a new wave of demand, given that many traditional investors prefer the regulatory safeguards and convenience that ETFs offer.

A list of recent Crypto ETF filings, Source:

Meanwhile, the coin’s recent attention comes from the new Department of Government Effectiveness, created by executive order from President Donald Trump. Although its official mission statement remains secret, the department’s acronym, DOGE, briefly appeared alongside Dogecoin branding on its initial websitecausing a frenzy on social media.

The site has since removed the Dogecoin logo, but the association brought unexpected visibility. Elon Musk, who has often championed the token, is involved in the department’s leadership, fueling speculation about possible government initiatives that could boost memecoin’s status.

Whale Accumulation and Bullish Price Projections

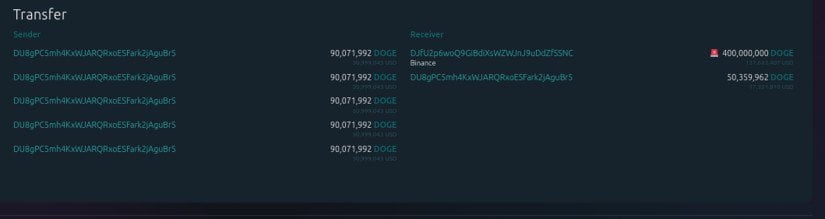

Another major factor in confidence is the behavior of large operators. Recent data shows a significant increase in whale trading as wallets holding 10 million to a billion Dogecoin added around 590 million DOGE when its price dropped to $0.33. This trend suggests a renewed conviction among the big players who seem to be betting on a longer-term rally.

Source: Whale dog activity

Technical indicators also suggest potential bullish momentum for Dogecoin. The token remains in an accumulation zone reminiscent of patterns seen since 2021, signaling sustained investor interest. A break above key resistance levels could propel DOGE towards $0.95, while a bull flag pattern forms on the short-term chart, as indicated in a trader’s chart below. independent, indicates the possibility of the price exceeding $2. These signals, combined with growing institutional support, highlight a bullish outlook for Dogecoin.

Doge Bull Flag, Source: Mikybull tardigrade

Some traders see the token’s recent pullback to $0.33 as an opportunity. WSB Trader described this drop as a potential launching pad for another upward leg, suggesting that increased whale buying and growing interest in a Dogecoin ETF could create enough momentum to push prices higher.

Overall, regulatory optimism, high-profile endorsements, and whale activity have increased Dogecoin perspectives. While any investment carries risks, the possible approval of an ETF – and the added legitimacy it brings – has brought many eyes to the token. As one of the most recognized names in crypto culture, Dogecoin appears poised to remain in the spotlight, with new developments under the Trump administration and in the financial industry as a whole, perhaps paving the way for further gains for Dogecoin price in 2025.