Washington, DC – Crypto politics collide with digital finance as Trump’s coin launch sparks volatile market reaction, polarizing industry watchers and prompting regulatory caution .

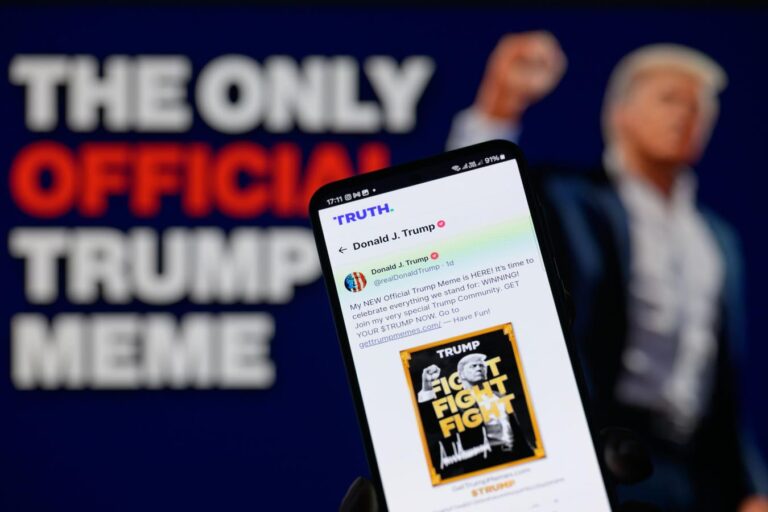

Donald Trump’s Truth account announcing the $TRUMP meme coin on January 19, 2025. (Photo by Jonathan … (+)

How the Story Began: Trump Engaged Top Bitcoin Miners on the Future of US Crypto

Leading Bitcoin mining companies, including Riot Platforms, Clean Spark and Core Scientific, summoned a closed-door meeting with Trump at Mar-a-Lago. This historic gathering appears to signal the former president’s intention to play an active role in shaping the US digital assets industry. David Bailey, CEO of Bitcoin Magazine, emerged as one of the industry’s influential spokespeople during his interactions with the Trump team.

Matthew Schultz, executive chairman and director of CleanSpark, proposed CNBC insights from the clandestine meeting:

“He wants to keep all the rest of bitcoin mining in the United States and outside of China. For him to be legitimately engaged in the bitcoin industry and understand how mining works was really awesome.”

Marathon’s Browder echoed this sentiment, praising Trump’s apparent understanding of complex cryptographic nuances:

“He really knew his stuff.”

The connection grows between Bitcoin and Trump

A few weeks later, at an annual Bitcoin conference, Trump took center stage, captivating an audience of fervent Bitcoin enthusiasts with an explosive and enthusiastic speech.

With iconic slogans like “fire Gensler“, a direct blow that could have led to the resignation of SEC Chairman Gary Gensler, and declaring “We will have regulations, but from now on the rules will be written by people who love your industry, not hate it. » Trump’s comments were likely the force that propelled the digital currency to new heights.

Since this electrifying speech, bitcoin has reached an all-time high of over $106,000 and has held impressively above $90,000 throughout 2025.

Underscoring his vision for the nation, Trump proclaimed it would transform the United States into “the crypto capital of the planet and the global bitcoin superpower.” Facing voter backlash, pro-crypto candidates made significant progress in the November 2024 elections. Politics declared“The return of President-elect Donald Trump and a potential Republican Congress offer a dream-come-true scenario for crypto executives and investors who have spent more than $130 million on the 2024 election.”

In an even more remarkable twist, crypto super PACs like Fairshake, NOW Armed with a formidable $78 million for the 2026 midterm elections, this indicates that crypto’s influence in the political arena is here to stay.

Crypto Ball: Trump Launches $TRUMP, Sparks Billion-Dollar Frenzy

The culmination of this complex dance between politics and digital finance occurred on January 17, 2025, at the inaugural ceremony in Washington DC.Crypto ball.” Hosted by industry powerhouses such as Bitcoin Magazine, Stand With Crypto, Kraken, Anchorage Digital, and Exodus, the event was set to celebrate a new era of crypto innovation and policy.

At around 8 p.m., Trump set social media ablaze with a bold message. announcement on Truth Social stating that he has launched his own memecoin, called $TRUMP.

Truth Social Announces $TRUMP Meme Coin

The market reacted instantly. In the hours following the launch, $ASSET The coin reached a market cap of $13.6 billion, with a fully diluted valuation climbing to around $67.6 billion. Then, at 3:05 p.m. ET on January 19, 2025, less than 48 hours after its launch, the coin began a sharp decline.

A divided industry

For some, Trump’s foray into memecoins is a triumph, symbolizing innovation and unorthodox leadership in a space ripe for mass adoption. “We are all extremely proud of what we continue to accomplish in crypto. $TRUMP is currently the hottest digital meme in the world, and I truly believe that World Liberty Fi. will revolutionize DeFi/Cefi and be the future of finance We are just getting started”, declared Don Jr. on X.

But not everyone shares this exuberance. British Bitcoiner and podcast host Peter McCormack, founder of What Bitcoin Didsuddenly critical the move:

“The Trump piece is embarrassing. It’s the opposite of what you voted for.”

Neeraj K. Agrawal, director of communications at digital asset think tank Coin Center, REMARK,

“Anyone else scared?”

Nic Carter, a staunch Trump supporter and crypto enthusiast, posted on X:

Nic Carter on X

Amid growing concerns about pump and dump schemes, a persistent problem in the crypto world exacerbated by the ease of token creation, regulators and industry participants are calling for vigilance. On-Chain Analysis highlighted the potential pitfalls of such projects, emphasizing the need for strong collaboration between the public and private sectors to build a safer ecosystem.

SEC Chairman Gary Gensler resignationeffective January 20, 2025, further complicates the landscape, leaving the industry at a crossroads between regulatory oversight and unbridled innovation.

The road ahead

As the crypto industry grapples with the twin forces of political ambition and digital innovation, the ripple effects of Trump’s maneuvers are poised to shape the future of American governance and of global finance. With a formidable mix of political capital, financial power, and the ever-present thrill of meme culture, the path ahead looks unpredictable.