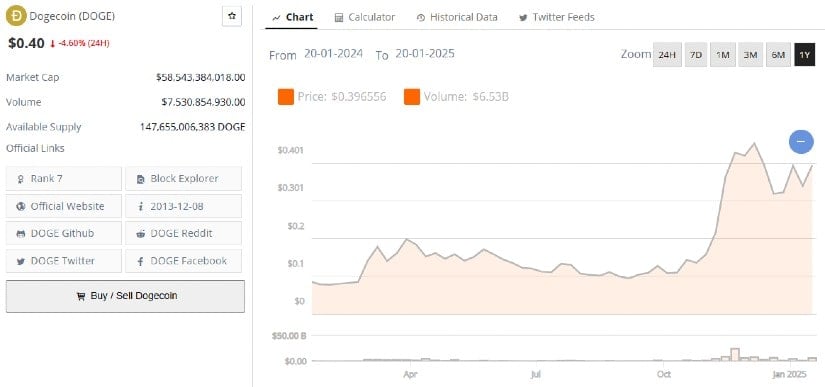

Dogecoin (DOGE) has seen a significant rise in recent weeks, with its price climbing to $0.397 and sparking renewed chatter about its potential to reach the elusive $1 mark.

As cryptocurrency gains momentum, analysts and traders are increasingly turning to optimisticciting both technical patterns and broader market trends as the main drivers of this potential rally which will take Dogecoin at one dollar.

Historical Patterns and Market Dynamics

Historically, January has proven to be a strong month for Dogecoin, with an average gain of 85% compared to previous years. This seasonal trend, combined with recent whale activity, has bolstered predictions of a potential 140% rebound that could push DOGE at $1 level. Analysts point to Dogecoin’s ability to capture retail interest, driven by its meme appeal and loyal community, as another factor setting the stage for its upward trajectory.

A 140% gain from the current price level could help Dogecoin cross the $1 mark. Source: TraderRocko via

Political developments also play a role in market developments. With the arrival of a pro-crypto US president, optimism around favorable regulatory policies is fueling bullish sentiment. Analysts believe such developments could encourage wider adoption of cryptocurrencies, including Dogecoin.

Whale activity fuels optimism

The increased activity of whales, or large investors, has been one of the main catalysts for Dogecoin’s price action. On January 17, approximately 600 million DOGE tokens were transferred from two large wallets, worth over $231.5 million. Such transactions tend to reflect an increase in institutional investor confidence. This would generally create market turbulence and increase trading volumes even further.

Some market experts believe that Dogecoin could reach $1 before the end of January 2025. Source: TraderRocko via

Whale activity is often a precursor to large price movements because these investors typically have access to advanced market information. Their actions can also influence retail traders, thereby amplifying the overall market effect.

Technical indicators signal bullish outlook

From a technical point of view, Dogecoin recently formed a bullish “cup and handle” pattern on its weekly chart, a structure that often signals continued bullish momentum. Based on this trend, experts predict a price target of $1.38 if the rally fully materializes.

Immediate resistance at $0.47 could play a crucial role in deciding the next market bias for Dogecoin. Source: DaanCrypto via

Key support levels include $0.35 and $0.285, which are likely to act as safety nets during potential market pullbacks. Should Dogecoin If further accumulation is seen around these levels, it may provide a stronger basis for future gains.

Additionally, this recent break below the $0.40 level is considered a major trend reversal. If the token stays below this level, traders believe it could open the door to a sustained rally similar to DOGE’s 222% surge in November 2024.

Dogecoin (DOGE) price chart. Source:Brave new piece

Retail traders will also play a crucial role in the DOGE journey. Mentions and discussions on social media often lead to increased engagement, creating a snowball effect that feeds off demand. As analysts noted, when DOGE online trends, the trend is really “strong”, similar to that of the cryptocurrency during its previous big bull runs.

The road ahead

Even if the possibility of Dogecoin hits $1 by February is increasingly plausible, the cryptocurrency market remains unpredictable. Traders are advised to closely monitor market sentiment, whale activity and key price levels. Even though the path to $1 is filled with optimism, cautionand strategic decision-making remains essential to navigating this volatile landscape.

Dogecoin’s rise has captivated both retail and institutional investors, and with market dynamics aligning favorably, its journey to $1 could mark an important step in the cryptocurrency space. Whether or not it achieves this goal, DOGE continues to solidify its status as a major player in the crypto market.