Pepe (PEPE), the popular crypto-meme coin, showed its intention to rebound massively after breaking out of a prolonged consolidation and bullish price action. Alongside major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), PEPE saw a notable price rise of over 10% and broke the resistance it had been facing since early December 2024.

Pepe (PEPE) Technical analysis and upcoming level

According to CoinPedia’s technical analysis, PEPE, with today’s price surge, broke out of a descending triangle price action pattern and paved the way for a massive rally. However, this break in the current bullish market sentiment is more favorable to PEPE holders.

Based on recent price action and historical price momentum, if PEPE maintains its gain and closes a daily candle above the $0.000020 level, it could surge 38% to reach the mark of $0.000027 in the coming days.

Currently, PEPE is trading above the 200 exponential moving average (EMA) on the daily time frame, indicating an upward trend. Meanwhile, its relative strength index (RSI) is still below the overbought zone despite a notable gain, suggesting that the asset has enough room to soar in the coming days.

Current Price Dynamics

Today, January 17, 2025, with an impressive price rise, the meme coin is trading near the $0.000020 mark. Additionally, given the impressive price momentum and bullish outlook, traders and investors have shown keen interest and confidence in the meme coin, leading to a 30% increase in trading volume.

On-chain bullish metrics

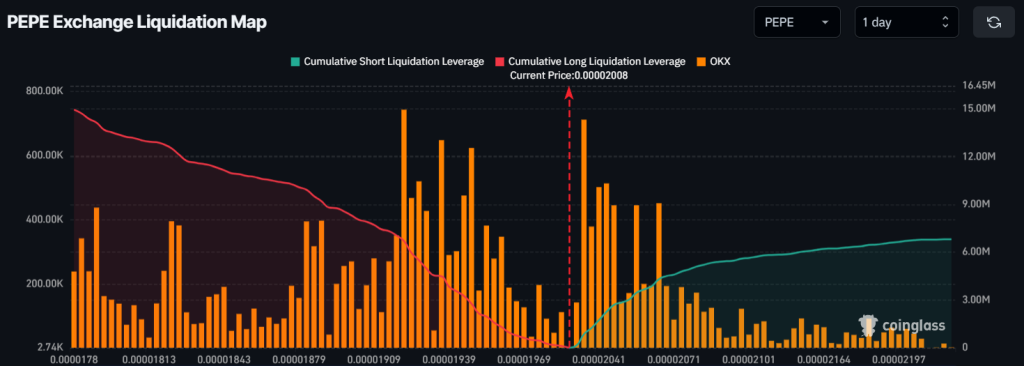

However, traders seem more optimistic about the meme coin, as reported by the on-chain analytics company. CoinGlass. The data revealed that traders are heavily overleveraged at the $0.000019 level at the bottom and $0.00002044 at the top.

These two levels are where bulls have built long positions worth $6.70 million and short sellers have built short positions worth $2.25 million, which are on the point of being liquidated if the PEPE price crosses these levels.

Additionally, traders’ open positions appear to be continually increasing. According to CoinGlass data, PEPE’s open interest (OI) jumped 15% in the last 24 hours, indicating that bulls are back in the market.