PEPE has shown resilience despite continued bearish market conditions, maintaining its position above a critical support level.

Investors refrained from selling in significant volumes, creating a scenario that could allow the altcoin to recover from the recent price decline. This restricted sales activity provides protection against further losses.

PEPE investors back away from the sale

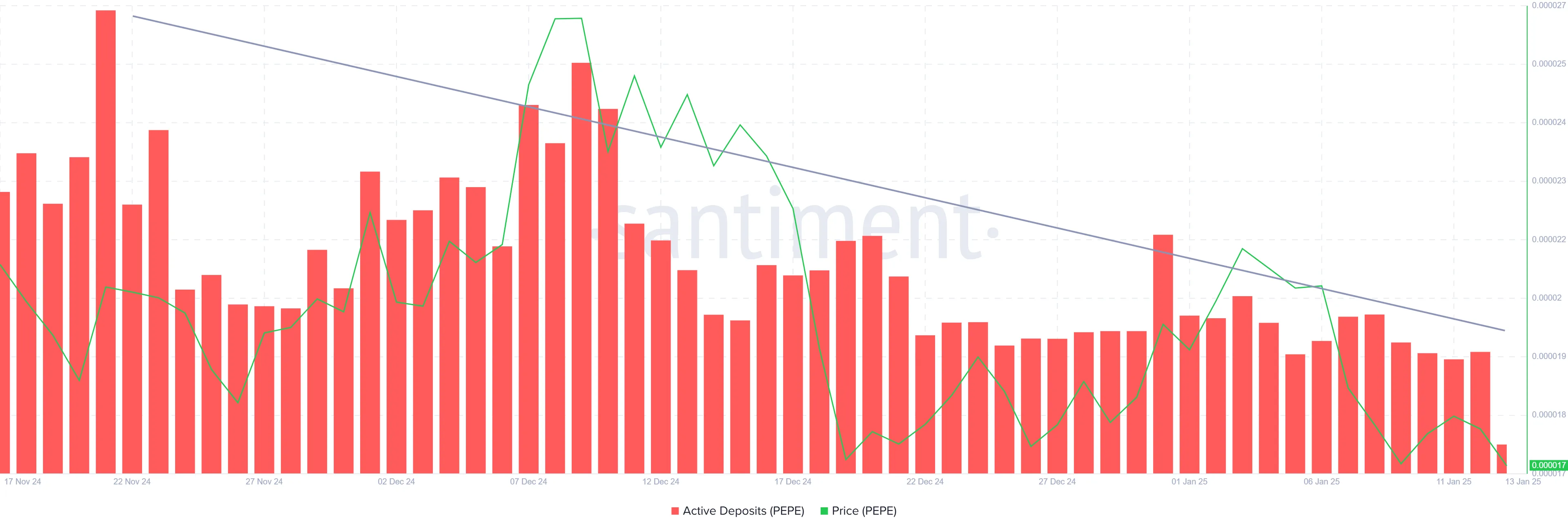

Active deposits for PEPE have been declining steadily over the past few weeks and are now set to stop. This drop in deposits is a positive signal, indicating a reduction in selling pressure from holders. Lower active deposits often correlate with less intention to liquidate assets, giving the cryptocurrency more room to stabilize and recover.

Given The struggle of PEPE In bearish market conditions, reducing sales activities is a crucial factor in supporting a potential price rebound. As deposits continue to slow, the altcoin is better positioned to consolidate and regain bullish momentum in the coming days.

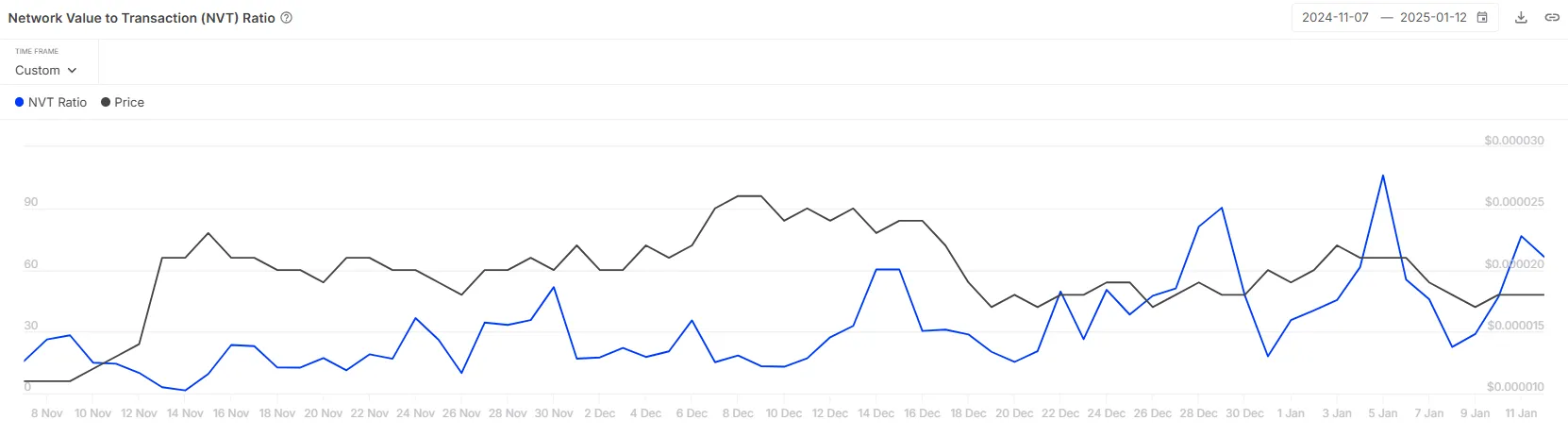

The macroeconomic dynamics of PEPE is influenced by its network value-to-transactions (NVT) ratio, which has recently increased. A rising NVT ratio reflects increased network activity relative to transaction activity, often triggering corrective price actions. This trend has contributed to the difficulty of PEPE to recover in a context of generalized bearish market.

The high NVT ratio prevents a significant recovery in PEPE by amplifying bearish conditions. However, as this ratio stabilizes and network activity more closely aligns with trading volume, the meme coin could find the support needed to initiate a rebound.

PEPE price forecast: holding continues

The price of PEPE failed to reclaim the $0.00001785 support level over the past 48 hours, following a 21% correction last week. The altcoin is now trading at $0.00001696, with this level acting as a critical support floor. Maintaining this support is essential for an eventual recovery.

Despite several tests, PEPE managed to hold $0.00001696 as support, reinforcing its importance. If this level remains intact, the altcoin could rebound and target $0.00002062. The cessation of sales activities reinforces this optimistic outlook, creating the basis for upward momentum.

However, if PEPE fails To break above $0.00001785 and turn it into support, its ability to hold $0.00001696 could weaken. A decline below this support floor would invalidate the neutral bullish outlook, leaving PEPE vulnerable to a further decline to $0.00001489 and dampening investor optimism.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.