- BTC retested range lows at $91,000, before attempting a rebound

- XRP, DOGE and SOL withdrawals eased to levels, signaling potential recovery

Bitcoin (BTC) fell almost 10% over the past three days, triggering a market-wide sell-off in the altcoin sector. BTC dominance also jumped to 58% as investors liquidated their altcoin positions.

However, there was temporary relief on Friday after BTC stabilized above its all-time low of $91,000. The depreciation of major assets like XRP, Dogecoin (DOGE)And Solana (SOL) also slowed to its December demand levels. So, what’s next for these top altcoins ahead of the US jobs report?

XRP Price Prediction – Is a Breakout Imminent?

XRP has held up the selling better than any altcoin, indicating a strong market structure that could deliver an upside surprise. It was down just 6% and was above the 50-day EMA (moving average) at press time. A bullish breakout of the triangle pattern could lead bulls to $3.4 – a huge potential gain of +40%.

On the other hand, short sellers could prevail if XRP drops below $1.8. At press time, the market could go either way as key technical indicators were neutral.

Dogecoin Price Prediction – Is $0.3 the Local Bottom?

The dog-themed memecoin erased some of its November gains, but remained above its key multi-month trendline support.

Support halted previous pullbacks in October, November and December. Will this continue again in January? Most likely, based on the recent trendline bounce. If the rally extends, $0.35 and $0.30 would be the immediate upside targets.

However, a break below trendline support would invalidate the positive outlook. In such a scenario, short sellers could push DOGE down to its $0.27 and $0.21 levels.

Solana defends December demand levels

Solana dumped the most during the recent selloff. It has lost more than 17% over the past four days and saw a rebound on Friday. At press time, it was up about 4% after hitting a demand zone above $175 in December.

For the rally to continue, SOL had to break above trendline resistance. If so, the March highs of $210 and the $220 supply zone could be reached. However, the positive outlook could be clouded if the SOL decline extends below the December demand zone.

Read Solana (SOL) Price Prediction 2025-2026

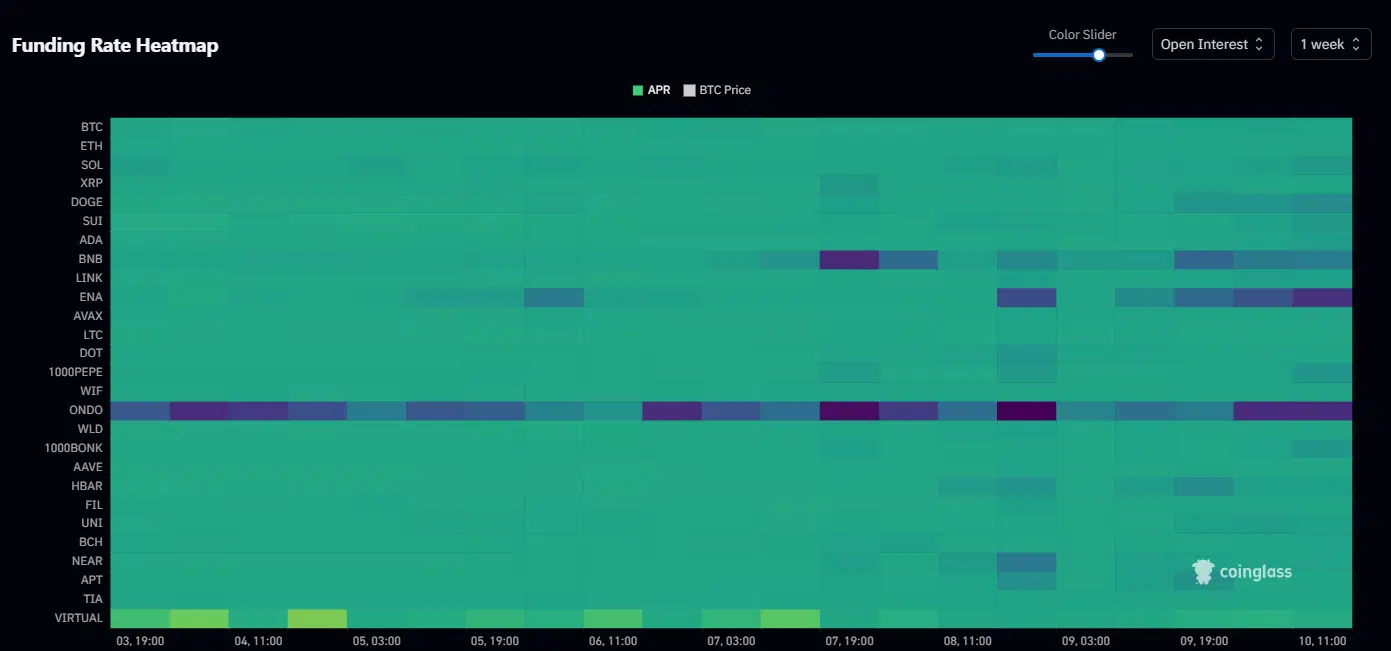

That being said, the sell-off triggered a funding rate reset and a healthy market scenario that could fuel the altcoin sector’s rebound. However, continued BTC dominance could derail the sector’s chances of recovery.