With a stalemate at $0.33, technical indicators suggest that Dogecoin could be on the verge of a reversal. Is a price recovery possible for DOGE in a declining crypto market?

As Bitcoin drops to $92,000, the meme coin segment has fallen below a $100 billion market cap. Dogecoin, down 3.33% in the past 24 hours, saw an overall decline of 4.08%.

With a market capitalization of $50 billion, Dogecoin continues to dominate more than 50% of its segment. However, the recent increase in supply has raised concerns among its holders.

Dogecoin Price Analysis

On the 4-hour chart, Dogecoin’s price action shows an unsuccessful attempt to hold above the 61.80% Fibonacci level at $0.37772, followed by a minor consolidation phase which lasted a few days.

However, with the broader market correction, Dogecoin fell after failing to break psychological resistance at $0.40. This correction led to a 24-hour low at $0.32417.

Despite this, underlying support at the 38.20% Fibonacci level at $0.33030 prevented a strong bearish close, leading to a brief consolidation. Currently, Dogecoin is priced at $0.33957.

The sudden increase in supply caused a bearish crossover between the 20 and 50 period EMA lines. However, the 4-hour RSI is moving sideways above the oversold limit, signaling a bullish divergence. This suggests that a potential Dogecoin rebound is still possible.

With blood in the streets, is it time to buy?

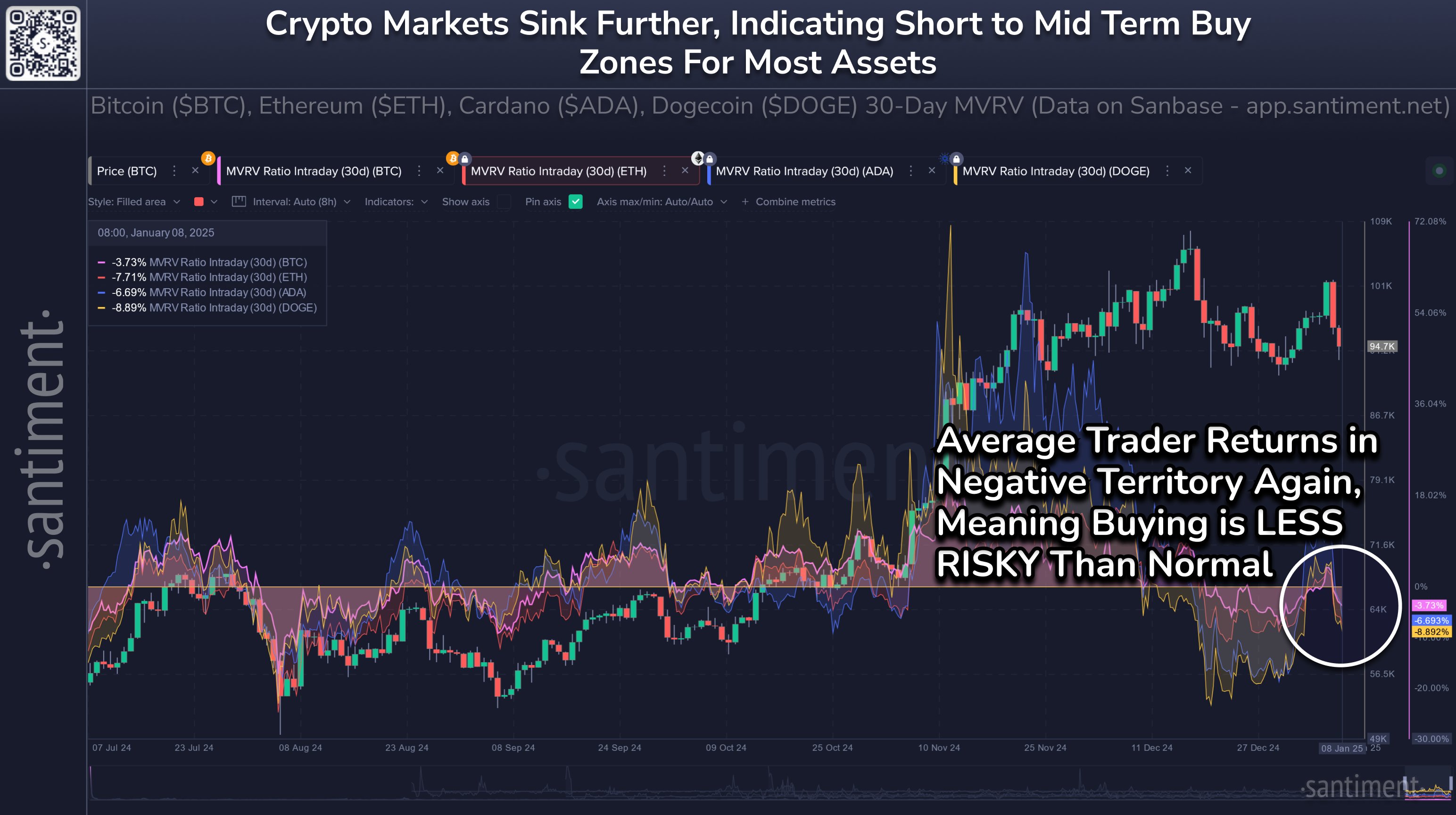

According to a recent tweet According to Santiment, average trading returns for Dogecoin are currently negative. This indicates that active portfolios in the last 30 days are showing losses and the MVRV (market value to realized value) ratio has become negative.

This could present a potential buying opportunity, with “blood on the streets”. Dogecoin’s MVRV ratio is at -8.892%, significantly higher than Bitcoin’s at -3.73% and Cardano’s at -6.693%.

DOGE Price Target

With the bullish divergence of the RSI and the likelihood of professional traders entering the market to take advantage of the reduced prices, Dogecoin could see a slight rebound. Immediate resistance is near the 50% Fibonacci level and the 200 EMA at $0.35.

Beyond that, the uptrend could face significant resistance around the psychological $0.40 mark. On the other hand, a downtrend could return to the crucial support zone around $0.30.

DisClamier: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.