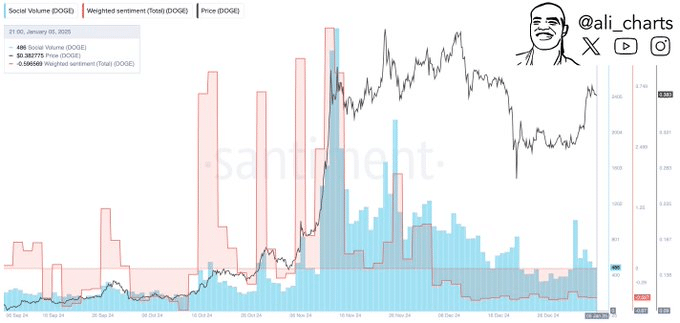

- DOGE’s weighted social sentiment remains at -0.60, reflecting continued public caution.

- If DOGE rises above the upper Bollinger band in the coming days, it could trigger a bullish rally fueled by renewed investor confidence.

Dogecoin (DOGE) has recently attracted the attention of traders with mixed performance. After recovering to $0.38641, a -1.23% decline following its recent rally, sparking optimism for a possible breakout.

Historical trends suggest explosive potential for $DOGE, as it has already surged 1,000% in 42 and 27 days in previous bull runs.

The historic average return of 83.9% in January is further fueling speculation, alongside a reduction in selling pressure due to a large transfer of 399.9 million DOGE from Binance to a private wallet.

Despite these bullish signals, DOGE’s weighted social sentiment remains at -0.60, reflecting the public’s continued caution, according to X (formerly Twitter) analyst Ali.

This report delves deeper into technical and on-chain metrics to assess the trajectory of $DOGE for the coming weeks.

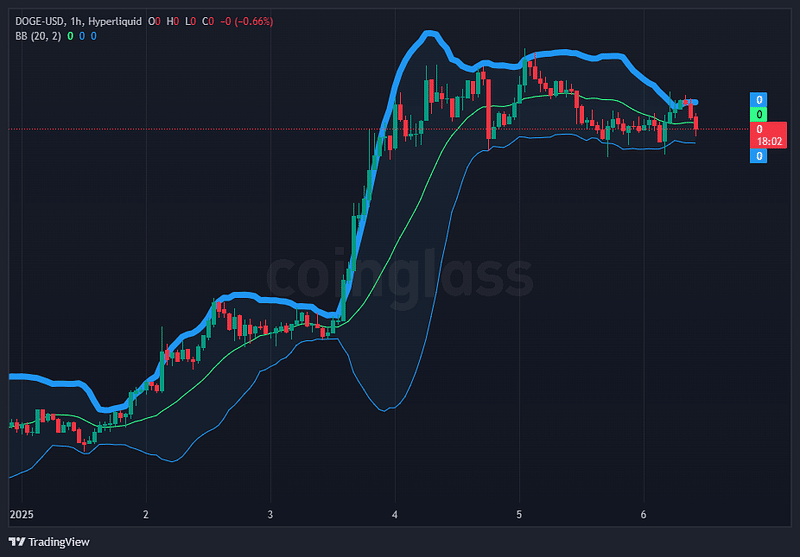

Identify volatility and breakout potential

Bollinger Bands provide insight into DOGE price volatility and potential breakout scenarios. Based on recent price action, DOGE has been consolidating after its November peak, with the bands tightening significantly in late December.

Bollinger band tightening often signals an upcoming breakout, up or down, depending on momentum.

The chart shows DOGE maintaining a steady rally near $0.386 with the price hovering around the middle Bollinger band. This reflects balanced market pressure after a recent decline. The narrowing range suggests reduced volatility, indicating a possible preparatory phase for a major move.

If DOGE rises above the upper Bollinger band in the coming days, it could trigger a bullish rally fueled by renewed investor confidence. Conversely, a fall below the lower band could trigger selling pressure.

However, the reduction in circulating supply, as indicated by the Binance wallet transfer, favors the bull case. Traders should monitor this indicator closely, especially given Dogecoin’s history of sharp price action.

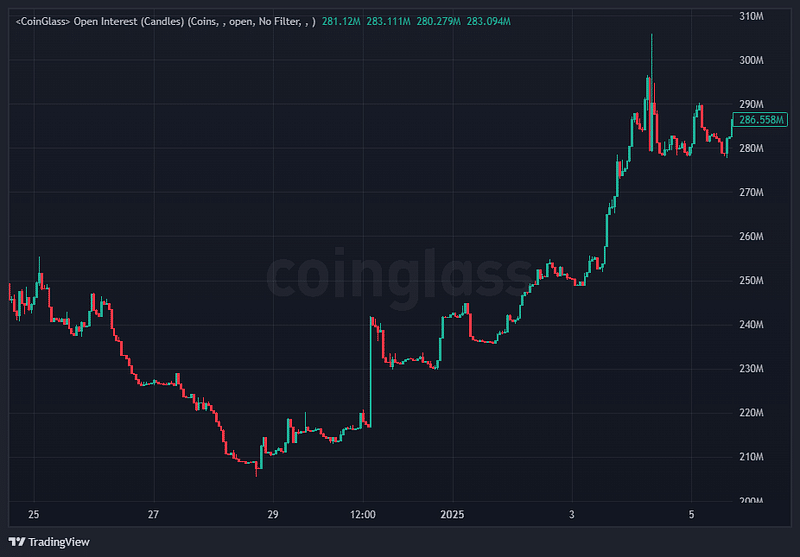

Overview of trader engagement and future price action

Open Interest (OI) provides a deeper look at trader sentiment and capital flows. Recent data shows a notable rise in DOGE’s OI, coinciding with its price recovering to $0.386.

Source: CoinGlass

This increase suggests growing interest in DOGE’s potential rally, as traders position themselves for a breakout scenario.

Higher open interest generally accompanies periods of price volatility. If DOGE’s OI continues to rise without corresponding price movement, this could signal potential liquidation risks for overleveraged positions.

Conversely, a regular increase in prices accompanied by an increase in OI would confirm an upward dynamic driven by the entry of new capital into the market. In light of reduced selling pressure and January’s strong historical performance, the current OI trend supports the case for a potential rally.

The essentials

Dogecoin is going through an intriguing phase, marked by price consolidation, mixed sentiment, and strong historical patterns suggesting a potential bullish breakout.

Bollinger bands indicate tightening volatility, signaling that a major price move could be imminent. Open interest shows increasing trader engagement, increasing the likelihood of a significant trend change.

While current weighted social sentiment (-0.60) shows continued public skepticism, historical data and on-chain indicators paint an optimistic picture for January. This month is known for Dogecoin’s past strong returns.

Read Dogecoin (DOGE) Price Prediction 2025-2026

With reduced selling pressure and increased trader interest, DOGE’s outlook for the coming weeks appears optimistic. However, traders should remain cautious of external factors that could disrupt the momentum.

For those with a contrarian mindset, this could be the perfect time to align with DOGE’s historic explosive growth trend.