Shiba Inu main coin (SHIB) has seen its prices rise steadily over the past week. This price rise has been fueled by the accumulation of its large holders, commonly known as whales.

This consistent buying pressure has positioned SHIB for further potential gains, with the coin now targeting a monthly high.

Reduced Shiba Inu Sales and Whale Interest Fuel Rally

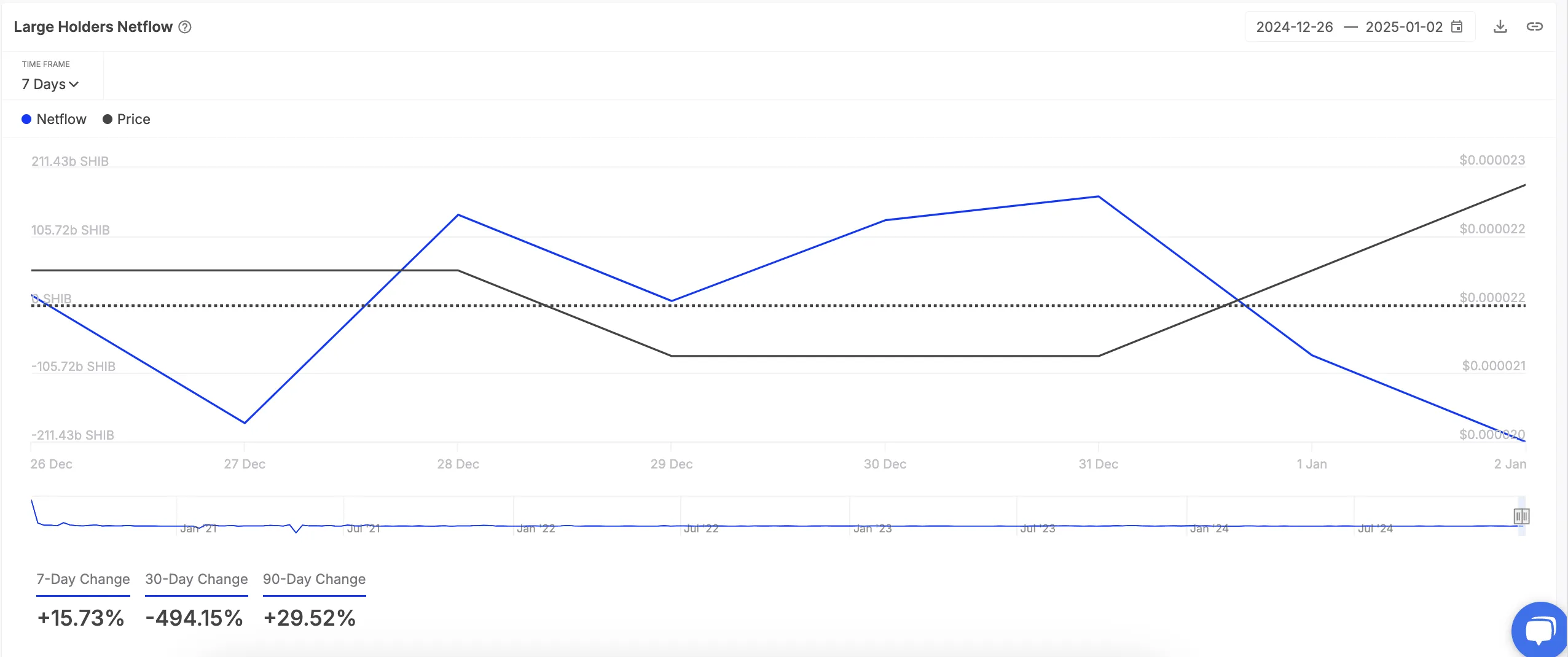

According to IntoTheBlock, SHIB noted a 16% increase in net flow from its large holders over the past week. These are whale addresses that hold more than 0.1% of the circulating supply of the meme coin. Their net flow tracks the difference between the coins they buy and the amount they sell over a specific period.

When the net flow of large holders increases for an asset, it means that more tokens are entering the portfolios of large investors or institutions than are leaving. This trend indicates that these holders are accumulating the asset, a sign of confidence in its future value.

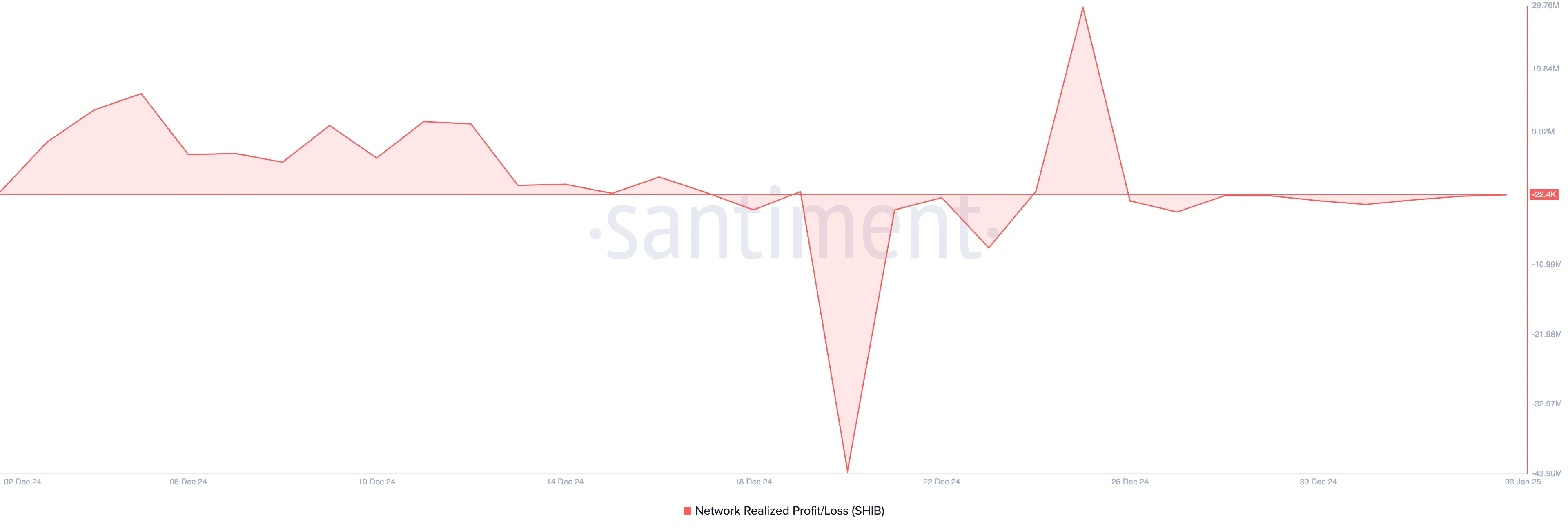

Further away, SHIB Price Rise was also driven by the reduction in sales activities in the general market due to fear of incurring losses. According to Santiment data, the negative profit/loss measurement made on the coin’s network indicates that many traders who sold their coins over the past week did so at a loss.

Thus, the desire to make gains on their investments has deterred many SHIB holders to sellcontributing to its price rise.

SHIB Price Prediction: Profit Taking Could Lead to a Drop

At press time, the meme coin is trading at $0.000022. If the selling pressure remains minimal and its whales intensify their accumulation, Shiba Inu coin price will break through the resistance at $0.000026 and revisit the monthly high of $0.000033.

On the other hand, if traders start taking profits and selling pressure builds, the coin itself could lose its recent gains and falls below $0.000021.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.