The cryptocurrency market was hit by a surprising development: El Salvador hit a $1.4 billion deal with the International Monetary Fund (IMF), agreeing to adjust its Bitcoin policy.

Naturally, this caused a shockwave, triggering immense bearish momentum. As major cryptocurrencies collapse, meme coins thrive in the chaos. For what? Let’s find out.

Bitcoin Dips, Altcoins Follow

Bitcoin (BTC) saw a significant decline of 3.32%, trading at $97,697. Over the past 24 hours, its price ranged between $95,537 and $102,747. Its market capitalization now stands at $2.05 trillion and trading volume decreased slightly to $39.57 billion.

One of the main factors behind this drop is a massive outflow of $682.04 million from spot Bitcoin ETFs, with big names like Fidelity and Grayscale reporting significant withdrawals.

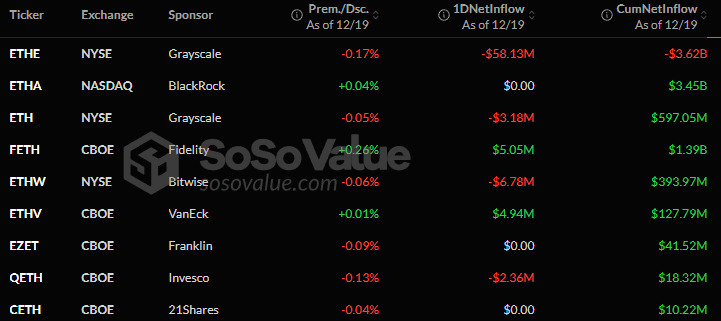

Ethereum (ETH) fell 6.52% to $3,420. Grayscale’s Ethereum ETFs saw outflows of $58.13 million, although Fidelity and a few other companies reported low inflows. However, the general feeling is negative. Total outflows from spot ETH ETFs reached $70.45 million, adding to the selling pressure on Ethereum.

Solana (SOL) was not spared either, falling 6.09% to $196.56. Although Solana’s trading volume increased slightly, it was not enough to offset the losses. Analysts believe that the downtrend could continue, especially for major altcoins, given current market conditions.

Meme pieces defy the trend

Amidst market chaos, meme coins are thriving. Solana’s Fartcoin, for example, has surged 608%, reaching a market cap of $1.18 billion since December 5. This shows that even in tough times, some investors are still willing to pursue risky, high-reward opportunities.

XRP has had a rollercoaster ride. After plunging 13% following the launch of stablecoin RLUSD, it managed a modest recovery of 1.51%. Although this rebound is small, it suggests that XRP investors are starting to regain some confidence.

Market Outlook: Bearish Currently, but Things Are Improving

The market seems uncertain to say the least. Bitcoin and Ethereum could see more selling as traders take advantage of any opportunity amid the current volatility. But there is some hope: The SEC’s approval of new ETFs could spur the integration of crypto into traditional finance, giving the market some long-term stability.

For now, the Fear and Greed Index stands at 62, meaning investors are cautious but not yet in panic mode. If you watch the market, expect more volatility in the short term.

The market is waiting with bated breath, but as always, the real test will come soon.