Disclaimer: The opinions expressed by our editors are their own and do not represent those of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

XRP is still at the top of the cryptocurrency market, up 20% in a single day, reaching $2.44. Currently, its market capitalization stands at $132 billion, making it the fourth largest cryptocurrency in terms of market value. Along with growing investor optimism, this spike has sparked discussions about whether XRP will hit $3 soon.

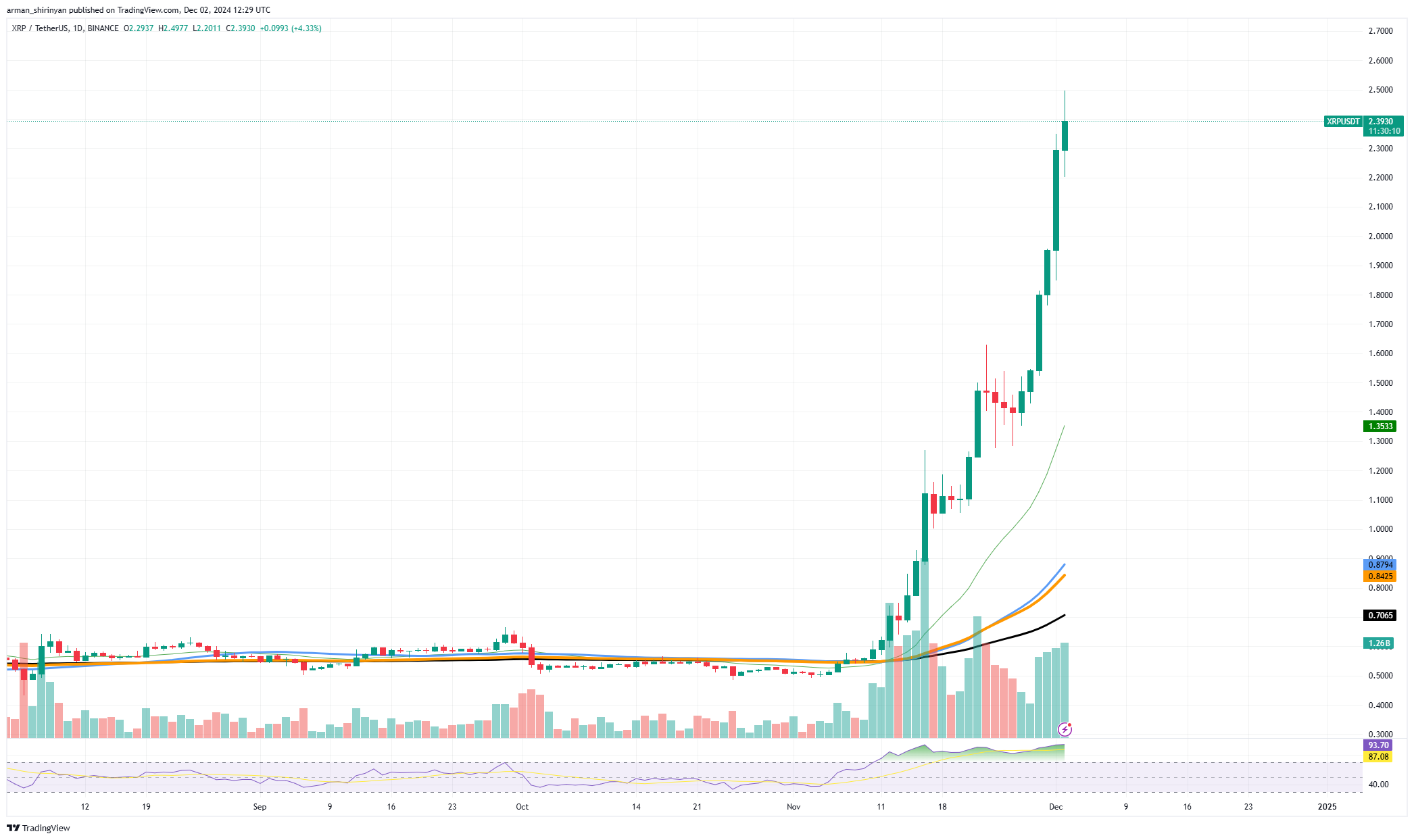

According to the price chart, XRP experienced a parabolic rise, decisively surpassing several resistance levels, including the notable $2 mark. Strong trading volume supports this upward trend, especially on the South Korean exchange Upbit, where it reached $3.69 billion. XRP’s distinct position in the current market cycle has been highlighted by the noticeably lower trading volumes of Ethereum and Bitcoin. The question now is whether XRP can continue on this path and reach $3.

Given current dynamics, this seems likely. Around $2.75 is the next important resistance level which, if broken, could open the door for a breakout of $3. With a price above $3, XRP will reach new highs for this rally, potentially reaching $3.50, depending on market circumstances and continued interest from institutional and retail investors. But it is important to remember that XRPThe RSI of is at 87, which indicates that the market is overbought.

This increases the possibility that there will be a period of consolidation or pullback before further upside. The $1.70 and $2.20 levels are important support levels to watch as they serve as buffers in the event of a correction. The rise of XRP to $3 is now a reality. With record trading volumes and solid fundamentals, this ambitious goal rests on solid foundations.

Shiba Inu attracts attention

With an exceptional breakthrough, Shiba Inu attracted market attention and strengthened its position above the critical $0.00003 level. This move demonstrates new momentum as SHIB has effectively overcome significant resistance levels, driven by strong buying interest and increasing trading volumes.

According to chart analysis, the recent rally indicates that SHIB is emerging from a period of consolidation, propelled by an increase in market activity. A positive indication is the continued upward momentum of the price, although it briefly touched $0.000031 before pulling back slightly. The 21 EMA served as reliable support, and the strength of this move was reinforced by the breakout and increasing trading volume.

Staying above $0.00003 is not assured, however, especially in light of broader market dynamics. The general state of the cryptocurrency market is still unstable and SHIBThe RSI of is overbought at 70, indicating that there could be a brief correction or consolidation. The $0.000027 amount could provide instant support in the event of such a pullback, with $0.0000249 being the next crucial level to watch.

On the positive side, further gains could be possible if SHIB manages to maintain its position above $0.00003. Based on market sentiment and current bullish momentum, a successful break above $0.000032 could lead to $0.000035 or even $0.00004. SHIB will need sustained support from the broader market, particularly from Bitcoin and Ethereum, which frequently drive altcoin moves in order to continue its upward trajectory.

Bitcoin not ready?

Bitcoin appears to be stagnating as it approaches the long-awaited $100,000 mark. The cryptocurrency appears to be consolidating below $98,000 after a notable rally in recent weeks, raising the question of whether the bullish momentum is losing steam or simply stopping for more market movement.

According to the analysis of the graph, Bitcoin is currently trading near $96,000, which is just below the psychological resistance level of $100,000. A break above this level, which constitutes an important barrier, could trigger the subsequent burst of bullish momentum. As market sentiment cools and profit-taking accelerates, a pullback is all the more likely as Bitcoin struggles to reclaim $100,000.

The recent breakout zone and the 21 EMA are in line with $90,400, which provides key support. Bitcoin could move towards the $80,400 support, which is in line with the 50 EMA and acts as a strong safety net for the current uptrend if it breaks below this level, which could indicate further downside pressure.

With a current Relative Strength Index of 71, the market is overbought. While this is not necessarily a sign of decline, it does imply that the market may go through a period of consolidation or a brief correction before attempting to move higher. Strong buying pressure is required to break through current resistance levels in order to Bitcoin to regain its bullish momentum and head towards $100,000. The bulls might be able to reopen the path towards $100,000 and possibly $105,000 if they manage to push the price above $98,000 with heavy trading volume.