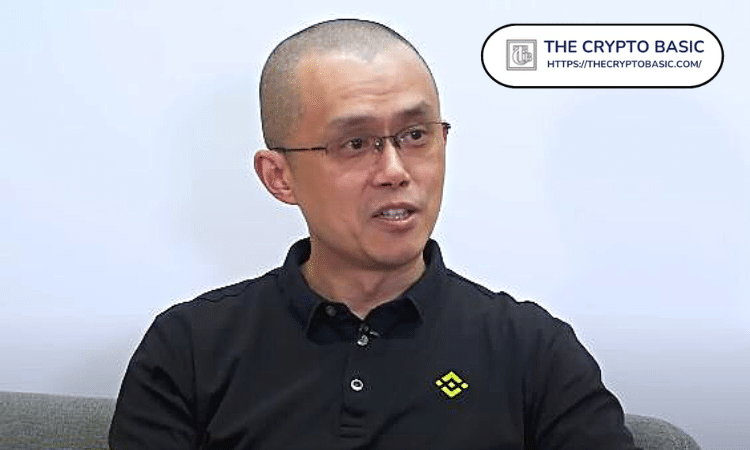

Binance co-founder Changpeng Zhao (CZ) has urged the cryptocurrency industry to focus on true blockchain applications, calling the meme coin trend “a little weird.”

His comments come as the meme coin market has seen a significant slowdown. Its total market capitalization fell to $120 billion, a 7.5% drop in just 24 hours.

This decline aligns with the broader crypto market retracement, sparking new discussions within the crypto community about the state of meme coins and their place in the blockchain ecosystem.

The community divided on the role of Meme Coins

In a tweet today, Binance’s CZ shared his concerns about meme coins, questioning the growing craze surrounding them. “Meme pieces are getting a little weird now,” he said.

As a result, he encouraged the industry to prioritize the development of true blockchain solutions. His comments received both support and criticism.

I’m not against memes, but meme pieces are getting “a little” weird now.

Let’s create real applications using blockchain.

– CZ 🔶BNB (@cz_binance) November 26, 2024

IncomeSharks, a platform known for its market education, echoed Zhao’s sentiment: describing meme pieces went from entertaining to “extremely strange and desperate.”

Meanwhile, analyst Willy Woo REMARK on the evolution of blockchain applications, comparing the current trend of meme coins to the first use cases of blockchain gaming.

Others, like Dark Crypto Larp, critical Binance’s listing choices, alleging a focus on meme coins rather than utility-focused projects. Larp suggested that Binance could better lead the industry by prioritizing innovative applications.

This talk emerged when Binance Futures launched perpetual contracts for two meme coins, 1000WHYUSDT and 1000CHEEMSUSDT, with high leverage options. Following the announcement, both tokens saw sharp declines, with WHY falling 30% and Cheems losing over 50% of its value.

Meme Coin’s aggressive promotions raise concerns

Promotions of meme coins by influencers have also come under scrutiny. A report of Coinwire highlighted that 76% of meme coins endorsed by cryptocurrency influencers ultimately collapsed, and only 1% achieved significant growth. The report further states that most promoted meme pieces experience a 70% drop within a week of approval.

Interestingly, the performance of promoted meme pieces seems inversely related to the size of an influencer’s audience. Influencers with more than 200,000 followers typically see negative returns on their promotions, with average losses of 39% in one week and 89% in three months.

Conversely, smaller influencers with fewer than 50,000 followers reported more favorable results, including 25% positive feedback in the first week and an eventual 141% increase over three months.

Regardless, influencers continue to profit from their coins promotions. According to the report, an average promotional tweet earns influencers $399 while reaching around 15,000 views.

DisClamier: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.