Dogecoin ($0.4243 DOGE) is retreating after hitting its highest levels since May 2021, suggesting a growing sense of profit-taking among traders following Donald Trump’s victory.

DOGE price rally overheating

DOGE price fell 14.25% from its local high of around $0.480, reaching $0.412 on November 25. The memecoin’s highest correction coincides with its daily relative strength index (RSI) reading hovering above 70, which is considered an “overbought” zone – for two weeks.

The RSI’s move into this territory suggests that DOGE has seen strong bullish momentum, potentially leading to a short-term price pullback due to the rally overheating.

DOGE/USD daily price chart. Source: TradingView

The RSI’s recent high of 77.45 is a low from its November 13 high of 92.45. During the same period, Dogecoin rose by over 22.65%, indicating a growing divergence between DOGE price and momentum.

Typically, such divergence suggests that the bullish momentum behind the price surge may be weakening.

So, even if the price of DOGE increases, the decrease in RSI strength indicates that fewer buyers are entering the market or buying pressure is decreasing in the short term.

Bitcoin Below $100,000 Limits Dogecoin Price Rise

Dogecoin’s price decline is part of a broader decline in the crypto market, led by Bitcoin ($98,179 BTC) retreating after nearly hitting the $100,000 mark.

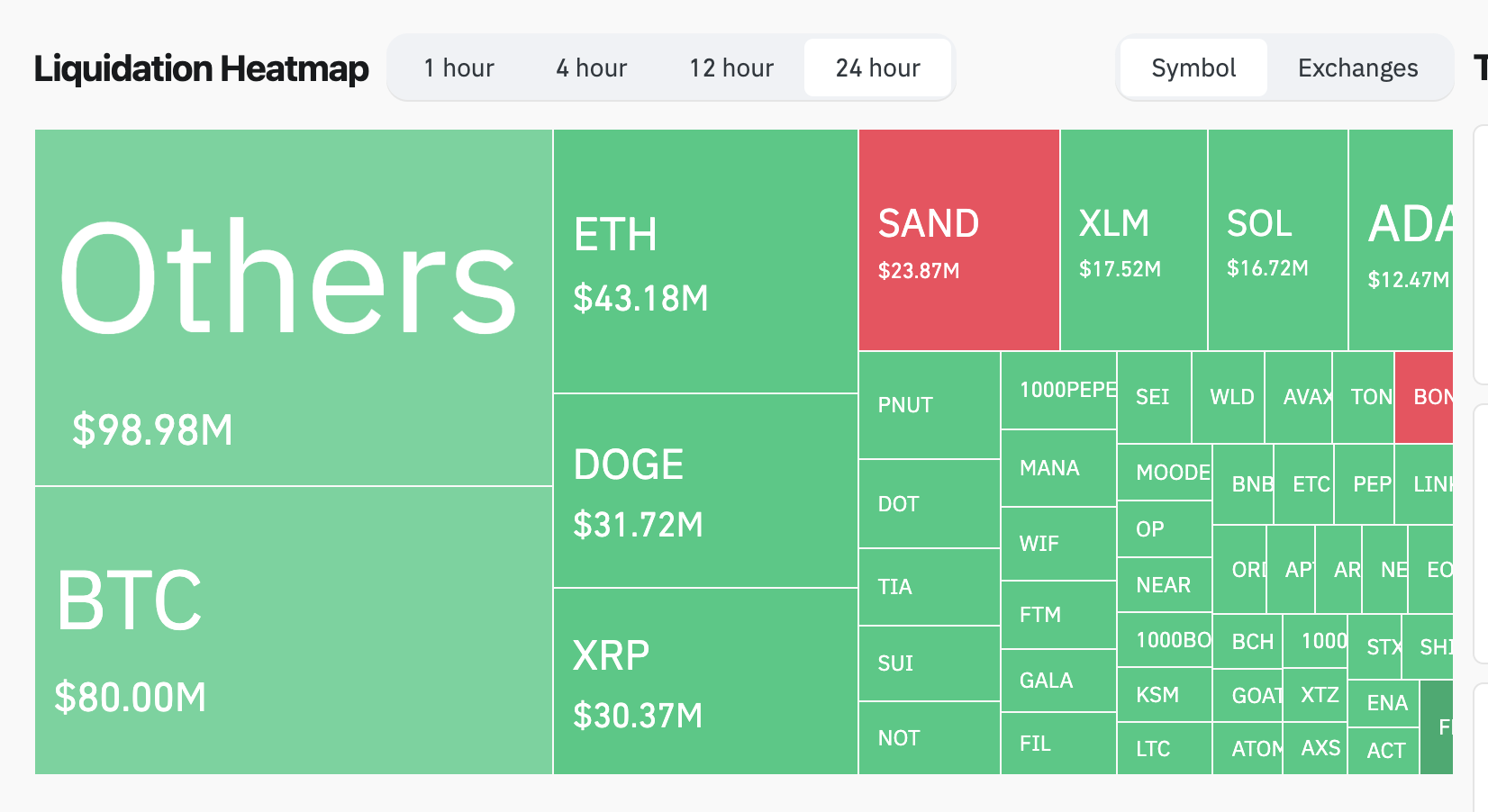

BTC price fell as much as 4% after hitting $99,800 on November 22. This triggered crypto market liquidations worth nearly $490 million over the past 24 hours, the most over a weekend in over six months.

Long and short positions accounted for $360.44 million and $128.93 million, respectively, with altcoins accounting for most of the liquidations.

Crypto market liquidation heat map. Source: Coinglass

The Dogecoin futures market saw liquidations worth $31.72 million, with long positions totaling approximately $21.72 million.

The large liquidations show that many traders were overly optimistic about the price of DOGE, expecting it to continue to rise.

When the broader market, including BitcoinAfter pulling back, these traders were caught off guard, leading to forced sales that contributed to Dogecoin’s price decline.

DOGE price continues 30% gains

Dogecoin’s continued price correction occurs after testing the upper trendline (~$0.44) of its dominant ascending triangle as resistance.

An ascending triangle forms when price moves between a flat resistance level and ascending trendline support, usually signaling a potential continuation of the prevailing uptrend if price manages to break above resistance.

DOGE/USD daily price chart. Source: TradingView

As a technical rule, the potential price target after the breakout is calculated by adding the triangle height (distance from initial resistance to the first low) to the breakout point.

Related: How High Can Dogecoin Price Go?

That said, a confirmed daily close above $0.44, accompanied by a significant increase in trading volume, would validate the bullish breakout, putting DOGE price on a path to $0.56 by the end of 2024, up 30% from current price levels.

Conversely, a pullback from the upper trendline of the triangle could push DOGE price lower towards the lower trendline target of around $0.40.