3:05 p.m. ▪

4

min read ▪ by

Memecoins are known for their meteoric rise before fading into obscurity. They attract traders looking for quick gains, but these investments are also synonymous with heavy losses. A recent study highlights a worrying phenomenon: on X, formerly Twitter, the majority of crypto influencers promote memecoins doomed to failure. Focus on these risky practices and their disastrous consequences.

Memecoins: a poisoned El Dorado thanks to influencers

Since April, there have been a million new crypto tokens heralding the phenomenon of Memecoin mania. However, all is not rosy for this asset class. The figures of Coinwire Study are unequivocal: 76% of crypto influencers on X promoted memecoins which no longer exist today. Among them, only 1% recommended projects that multiplied their value tenfold. The rest ? Assets doomed to collapse.

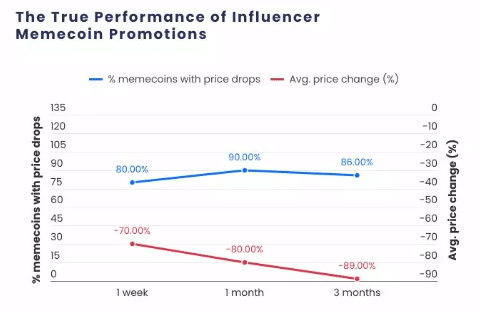

Why such a fiasco? Because many influencers favor immediate gainsto the detriment of naive investors. The memecoins they recommend see their value drops by 70% in the first weekreaching an 80% loss in one month and a total collapse in three months.

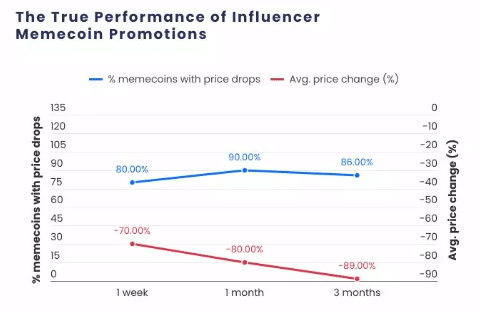

Some key figures on the promoted memecoins:

- 80% lose 70% of their value in a week;

- 90% drop 80% in a month;

- After three months, 86% lost ten times their initial value.

Some investors, like this Gen Z trader who pocketed $30,000 in an all-in, manage to take advantage of this volatility. But these are exceptions: the majority end up suffering heavy losses.

Crypto regulation: towards the end of influencer abuse?

Faced with these excesses, several regulators are trying to supervise the practices of influencers. Some are considering applying consumer protection laws promotions on social networks. But the challenge is colossal, because strategies evolve faster than the regulations.

Influencers with large audiences, especially those with more than 200,000 subscribersprove to be particularly harmful. According to the study, their promotions lead to 39% losses in one week and 89% in three months. On the other hand, small influencers (less than 50,000 followers) offer much better returnseven reaching +141% after three months.

As Coinwire points out:

» Investors should be wary of tempting promotions and examine the real value of projects. »

It remains to be seen whether the laws will really succeed in curbing this market where each tweet can ruin lives.

Thus, the memecoin crisis does not only affect ephemeral projects on Solana but expands to mainstays like Dogecoin and Shiba Inualready hit hard. In this merciless universe, caution remains the best weapon against the illusions sold by tempting tweets.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start enjoying benefits.

The blockchain and crypto revolution is underway! And the day when the impacts are felt on the most vulnerable economy in this world, against all hope, I will say that I had something to do with it

DISCLAIMER

The views, thoughts and opinions expressed in this article belong solely to the author and should not be considered investment advice. Do your own research before making any investment decisions.