Floki’s price hit its highest level since June 8 after Coinbase, the largest cryptocurrency exchange in the United States, listed it and as the crypto’s bull run continued.

Floki (FLOKI), one of the leading coins, surged to $0.00028, marking a 172% increase from its August low.

This rally occurred in an environment of high volume trading in the futures and spot markets. Spot market volume reached $1.68 billion, a significant figure considering Floki’s market capitalization of over $2.5 billion. Floki’s open interest in the futures market reached $40 million, its highest level since September 28.

Its volume is expected to increase further after listing on Coinbase, as the exchange has millions of users. Typically, cryptocurrency prices see significant gains after being listed on a top-tier exchange like Coinbase.

The Floki token has also benefited from a reduction in circulating supply due to its burn mechanism. Data from Crypto Eye shows that token burns have recently accelerated, reducing the circulating supply to over 4.12 billion tokens after 5.8 billion tokens were burned since its inception.

These burns primarily come from Floki’s ecosystem, which includes platforms like Valhalla, TokenFi, and FlokiFi.

Floki’s rise aligns with the ongoing crypto bull run that has pushed Bitcoin (BTC) almost $100,000. Memecoins and altcoins often perform well during such times, especially when the cryptocurrency fear and greed index rises.

Javon Marks, a prominent crypto analyst, predicts further upside for Floki, estimating a 92% increase from current levels based on a falling wedge pattern on the 3-day chart.

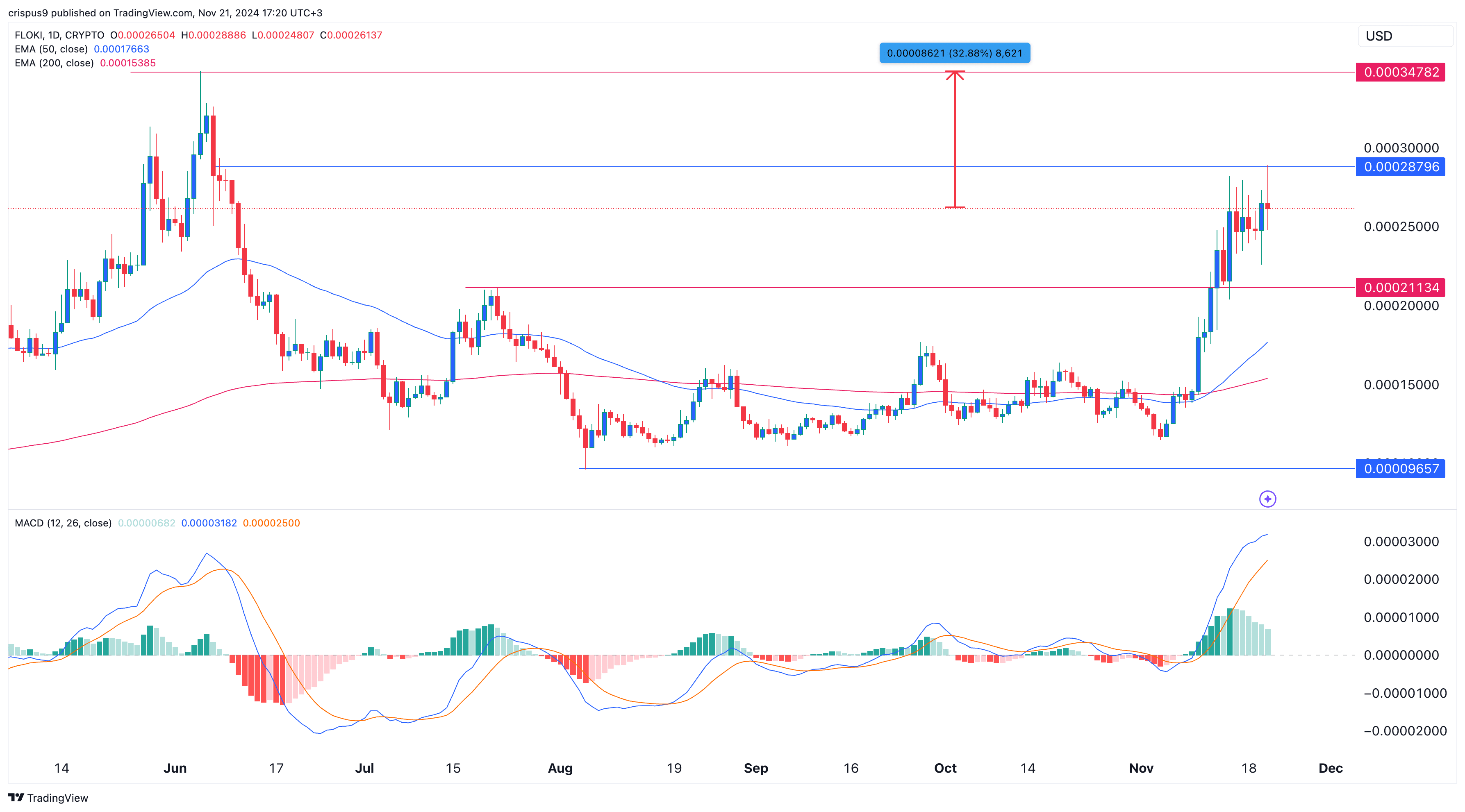

Floki price could jump 32%

The daily chart indicates a strong rally for Floki after its August low of $0.0000965. A golden cross pattern has formed at the intersection of the 50-day and 200-day exponential moving averages.

The MACD indicator has moved above the zero line and the coin remains above the key support level of $0.00021, the strongest move on June 22.

Further gains could be confirmed if Floki breaks the key resistance level of $0.00028, its weekly high. If that happens, the next target will be $0.00035, the June high, representing a 32% increase from current levels.