Dogecoin (DOGE) recently hit a three-year high of $0.43 on November 12 before retreating to $0.38, maintaining a 3% daily increase.

However, on-chain data shows that the price surge has led many long-term holders (LTH) to take profits. If this trend continues, DOGE risks losing much of its recent gains in the short term.

Dogecoin LTH sells for profit

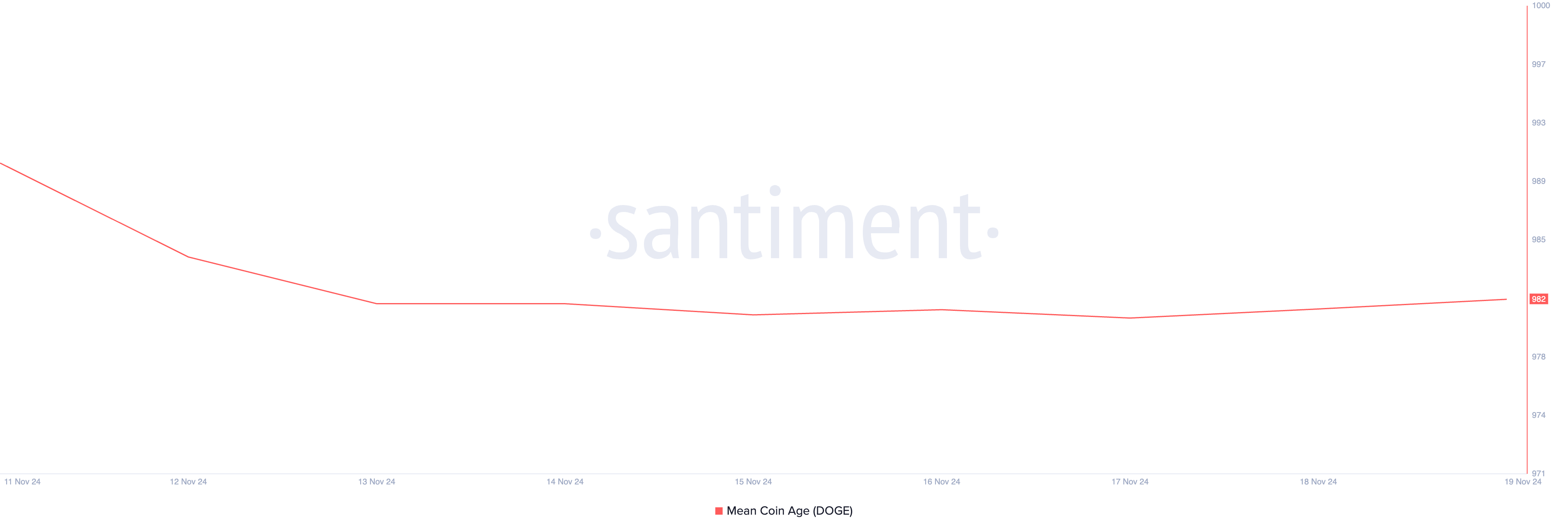

The evaluation of BeInCrypto on Dogecoin on-chain performance revealed a drop in its average coin age over the past week. According to Santiment, this figure has decreased by 1% over the last seven days.

Average coin age refers to the average age of coins in circulation. This provides insight into how long their owners held pieces before being moved or sold. When this metric decreases, it means that long-held coins are being moved or exchanged more frequently. This is often a bearish sign that indicates LTH could cash in on profits.

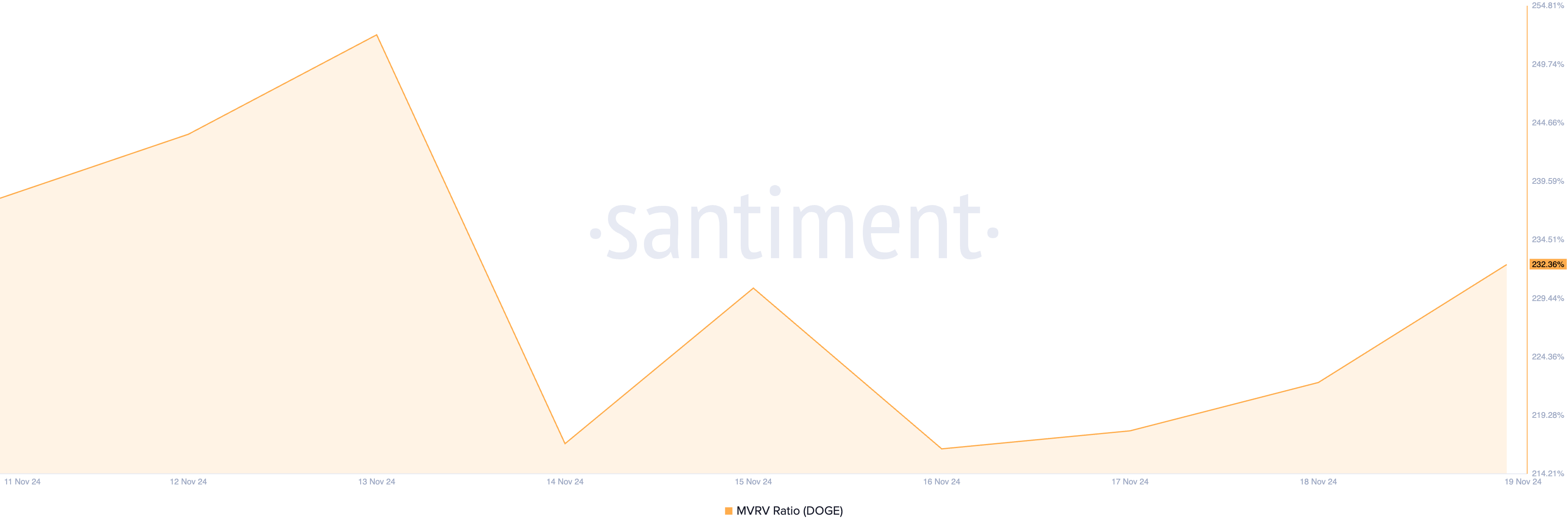

Furthermore, the positive results of DOGE Market Value vs. Realized Value (MVRV) suggests that the meme coin is currently overvalued. This may have influenced his LTHs to want to sell for profit. According to Santiment data, DOGE’s current MVRV ratio is 232.36%.

The MRVR ratio is a key metric used to analyze a cryptocurrency’s valuation in relation to its historical price trends. It compares the market value (the current price of all coins in circulation) to the realized value (the price at which the coins were last moved on the blockchain).

A positive MRVR ratio suggests that the market value is greater than the realized value. This indicates that the asset is overvalued. Historically, many see this as a signal to sell their holdings for profit.

At 236.36%, DOGE’s MVRV ratio suggests that its current market value is 236% higher than its realized value. So, if all its holders sold, they would realize an average gain of 236%. Such a high MVRV portends a prolonged period of price correction as more investors take profits.

DOGE Price Prediction: Why LTHs Need to Stop Selling

Currently trading at $0.38, DOGE is located just below the $0.39 resistance level. Increased selling pressure could push the price down to its support at $0.31.

Failure to maintain this level could trigger a more marked decline, push DOGE below $0.30 and potentially towards $0.21. Such a move would further push the price of DOGE meme coins further away from any rally beyond $0.47 and a return to $0.50, last seen in May 2021.

However, if market sentiment turns positive and long-term holders (LTH) hold on to their positions, increased demand for DOGE could push its price beyond $0.47, bringing the price zone back to 0 $.50 at your fingertips.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.