- Dogecoin Whales bought the decline by accumulating more than 530 million Doges

- DOGE has entered the control block area, an area with a large concentration of limit orders awaiting execution

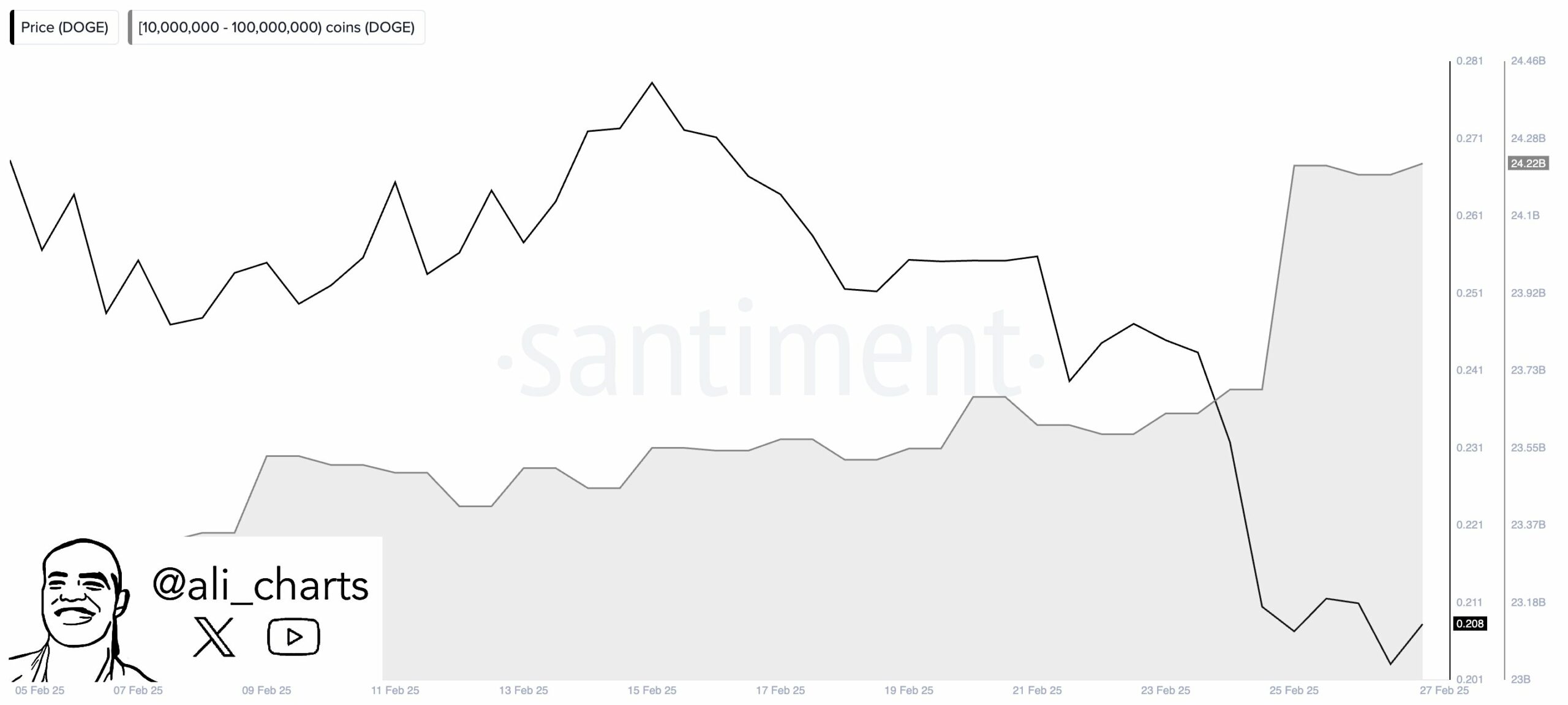

DOGECOIN (DOGE) The accumulation of whales has been on the upward trend lately. In fact, the figures for the same went from 23.55 billion Doge to around 24.46 billion Doge in just under a month.

This hike included a Net accumulation of around 530 million Doge In the last 3 days only. As the Doge price dropped, in particular after mid -February, the total DOGE held by these whales increased sharply – indicating the purchase of the hollows.

In particular, the lowest recorded price was about $ 0.208 at the end of February, coinciding with the highest level of accumulation – a sign that whales probably capitalized on lower prices to extend their assets.

If the whales continue to buy at lower prices, it could establish a stronger price support. Conversely, if these major holders are starting to sell, this could lead to a price drop.

This continuous increase model and a decrease in accumulation could be synchronized with price adjustments.

Large concentration of limit orders

Dogecoin recently plunged into an important control block area, which has historically served as a critical field of purchasing activity due to a high concentration of boundary orders.

More specifically, the area between $ 0.20 and $ 0.23 was historically placed with important purchase orders, anticipating potential price rebounds. When writing the editorial’s moment, Dogi seemed to hover just over this area at around $ 0.21.

This suggests that the limits of this beach are starting to be executed. As these orders are completed, the purchase pressure can cause the price to the north.

If Mastiff Consolid itself successfully above this area and absorbs the sale pressure, it could point out a bullish trend reversal. Potential targets could initially be about $ 0.30, while extending up to its previous summits at around $ 0.50.

Conversely, non-compliance with the support in this order block could lead to a drop in prices. This could stimulate a potential revision of the support levels of less than $ 0.11 to $ 0.09, where the next substantial control block exists.

RSI of Doge’s Handgage Diver

Finally, Doge’s optimistic divergence on the RSI alluded to a momentum at the high potential after a period of occurrence. More specifically, the RSI fell below the critical threshold of 30 as Trader Tardigrade noted X.

At the same time, while Doge continued to form lower stockings, the RSI began to diverge.

This divergence is a sign that the sale pressure is recently weakened. This often precedes an upward reversal. Conversely, if the expected bullish impulse does not materialize, DOGE could continue to test lower supports on the graphics.