Solana’s price remains in a lower market after falling by more than 33% of its summit of the year, with technical indicators pointing to a deeper drop.

Solana (GROUND) The token crashed at $ 184 on Monday and has hovered near its lowest level since February 2.

This slowdown coincides with the growth of the blocked network and the concerns concerning carpet prints in its ecosystem of coins. Coindecko data show that the market capitalization of all Solana’s corners of memes crashed more than $ 25 billion in January at $ 11.5 billion today.

Most of the solana memes pieces have dropped two -digit from their heights of all time. Official trump (ASSET) plunged from $ 103 in January to $ 18 today. Likewise, tokens like Fartcoin, AI16Z, Gigachad and Popcat have all decreased by more than 15% in the last seven days.

A common trend in Solana’s ecosystem implies that the developers launch coins, artificially inflating their value, coming out and leaving many traders with losses. For example, the initiates of Donald Trump took advantage of the Token Trump who had leapped, very hosting before the collapse. Consequently, concerns increases concerning the long -term viability of the ecosystem of the same.

This trend affected the volume exchanged in the Solana’s decentralized exchange protocols such as Raydium, Orca and Jupiter have withdrawn. The total volume abandoned From almost 25% in the last seven days to 26.21 billion dollars. It was overtaken by the BNB channel, which managed nearly $ 30 billion at that time.

Another sign of a slowdown in the Solana network is the decline in the activity of Stablecoin. The Total Stablecoin on Solana offer fell $ 772 million in the past seven days, while Ethereum has increased $ 1.1 billion in the same period. This is significant because stablecoins are the main means of exchange in the blockchain industry.

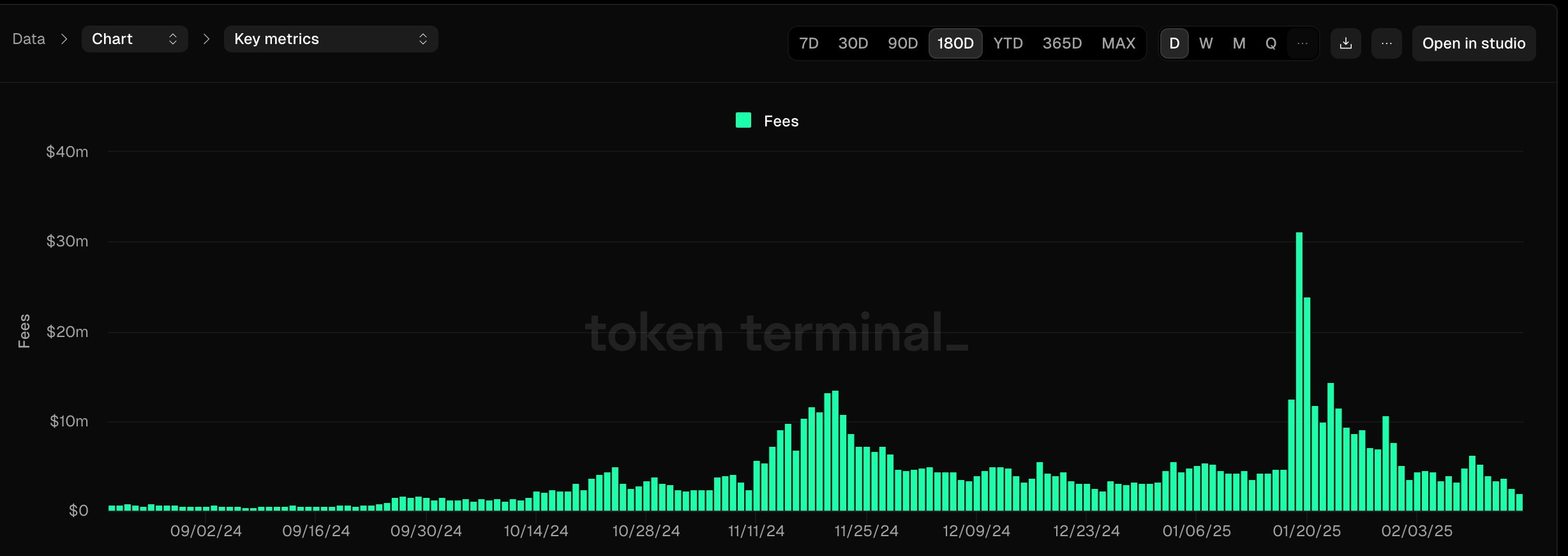

Additional data shows that the costs generated in Solana’s ecosystem have plunged in recent weeks. Daily costs increased from a peak of $ 31 million in January to only $ 2 million on Monday.

Solana Price technical analysis

The daily graph shows that the soil price has decreased after reaching a summit of $ 300 in January. He has now fallen to a crucial level of support, fighting to move below the ascending trend line which has connected his lowest oscillations since August 2023.

Solana approaches a death’s model, with the weighted mobile averages of 50 days and 200 days at the edge of a bearish crossover. It also approaches $ 170, the neckline of a double -top pattern formed at $ 265.

If soil falls below $ 170, there is a risk of downward ventilation at $ 110, which represents a 40% drop in current levels.