- The Dogecoin price decreased by 12.4% on Friday, trading below $ 0.19 for the first time since November 2024.

- The latest Dage slowdown coincided with peaks in daily active addresses, signaling an active sales pressure from retail merchants.

- Despite the trends in the territories of occurrence, the indicator of the index of relative resistance of the Doge continues to descend more down.

Friday, the price of Dogecoin dropped by 12.4%, negotiating less than $ 0.19 for the first time since November 2024. The data trends on the chain suggest that the sale of panic of merchants is at the origin of the last slowdown in Doges.

The Dogecoin price (DOGE) has plunged the lowest since November 2024

In the last quarter of 2024, Dogecoin (DOGE) has become a most efficient cryptographic asset, led by the UNITED STATES (United States) Elections.

Elon Musk’s collaboration with Donald Trump’s campaign has strengthened Dogecoin’s momentum while Trump has re -elected.

After providing three -digit growth in the fourth quarter The inauguration of Trump January 20.

Dogecoin price action | Dogeusdt

Dogecoin price action | Dogeusdt

Friday, the price of Dadecoin decreased up to 12.4%, negotiating below $ 0.19 for the first time since November 2024.

Having opened at $ 0.31 on February 1, DOGE has now dropped by 46% this month, at $ 0.19 at the time of the press.

Why does Dogecoin price drop?

Beyond a reaction from “sale-New-News” post-breach, February introduced new downward catalysts:

1. Trump’s prices on Mexico and Canada:

President Donald Trump announced 25% price On imports from Mexico and Canada, from March 4, aimed at combating drug trafficking, in particular fentanyl.

This policy has led investors to withdraw from volatile assets and the same, including Dogecoin.

2.. Controversial role of the government of Elon Musk:

Appointed to supervise the Ministry of Government (DOGE), Musk clashed with agencies such as USAID, US Treasury and Securities and Exchange Commission (SEC).

These disputes have unstable the financial markets, and the known links of Musk with the community of Dogecoin have amplified the lowered feeling towards the cryptocurrencycontributing to its 46% drop in February.

3. Detail traders panic while Doge loses $ 0.20

While the price of Dogecoin reflected the broader slowdown in the market this week, the chain data reveal that the loss of 46% Doge exceeds that of the BTC and the ETH, mainly due to the increased sales pressure of retail merchants.

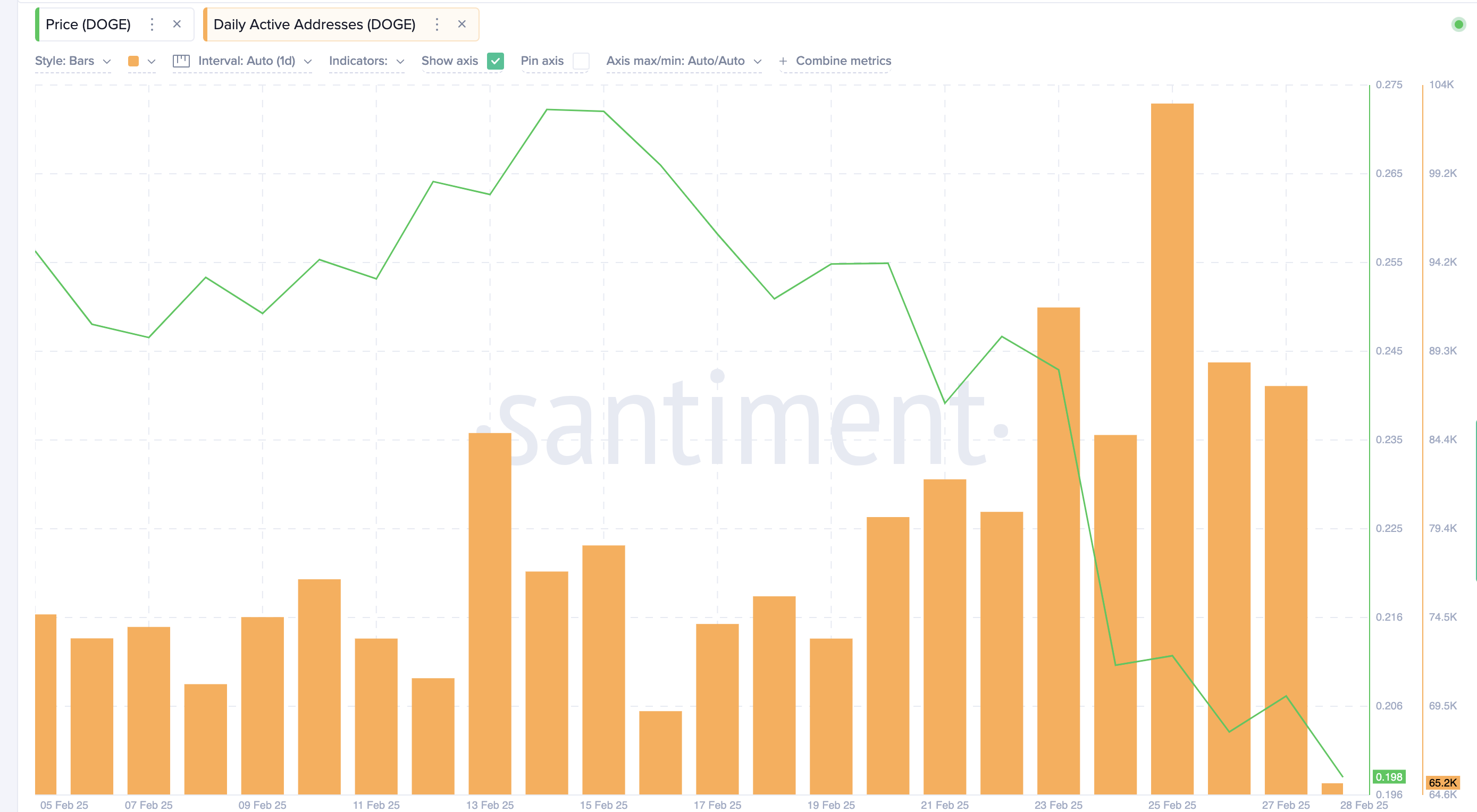

According to the Daily Active Address of feeling graph, Doge reached a February 103,500 active addresses when its price fell below $ 0.25 after Trump’s price announcement on Monday.

Since then, active addresses have remained greater than 88,000, with 87,414 observed Thursday.

Active Dogecoin Addresses compared to Doge Price | Source: Santiment

The increased number of active addresses during a price drop suggests that many retail traders are actively sold, losing a downward pressure on the price of dogecoin.

In summary, the recent drop in Dogecoin less than $ 0.19, influenced by geopolitical events and internal controversies, caused panic sales among retail merchants.

Without a significant increase in positive catalysts or institutional support, the Doge price can cope with additional short -term drop pressure.

Prediction of the dececoin prices: signals of the indicator of the cross of death still decreases forward

Dogecoine price forecasts remain cautiously lower because the meter piece slips below $ 0.20, which triggers concerns of prolonged losses.

The Daily Dogeusdt graph below shows a pronounced death cross, with the 50-day mobile average below the 200-day mobile average, a manual signal of a prolonged momentum.

This lowering crossing confirms the change of trend observed since the end of January, highlighting the impact of the negative opposite winds from the presidency of Trump.

Dogecoin price prediction | Dogeusd

The relative force index (RSI) is 26.37, deeply in the territory of occurrence, which suggests that DOGE can approach a short -term rebound.

However, the persistent descending slope of the RSI indicates that the sales pressure remains dominant.

A potential emergency rally could emerge if buyers recover the bar of $ 0.20, but the MA resistance of 50 days almost $ 0.29 could limit any recovery.

Conversely, the non-recovery of $ 0.20 can speed up drops to the next key support at $ 0.15.

The volume of negotiation remains high, which suggests a strong participation in the downward trend.

Without Haussier catalyst, Dogecoin risks more losses as a technique indicators Confirm a deterioration of the market structure.